For a lot of folks trying to buy a home in Tampa, the typical mortgage process can feel like a losing game. It’s like they’re trying to fit a square peg into a round hole. If you’re self-employed, a real estate investor, or your income doesn’t come from a standard 9-to-5, the strict rules of conventional loans can slam the door in your face. That’s exactly where a specialized Tampa non-QM mortgage lender like Residential Acceptance Corporation (RAC Mortgage) comes in, offering a real, powerful alternative.

Navigating Tampa's Unique Mortgage Landscape

The dream of owning a home in Tampa's buzzing market is very much alive, but let's be honest—the path to get there isn't always a straight line. Traditional lenders have a very specific checklist. They lean heavily on W-2s and tax returns to decide if you can afford a loan. This system is fine for salaried employees, but it completely misses the mark for many successful people right here in our community.

This guide is all about showing you a more flexible way to get into a home, one that’s built for the way people actually earn money today. Think of it as a roadmap for anyone who is financially solid but just doesn't fit into that neat, conventional lending box.

The Challenge for Tampa's Modern Borrowers

It’s frustrating, but many people with strong finances find themselves locked out of the standard mortgage process. The old-school system just wasn't designed for the unique income situations of:

- Self-Employed Entrepreneurs: Business owners are smart about maximizing tax write-offs. The problem? This can make their net income look lower on paper than their actual cash flow.

- Real Estate Investors: These are folks who depend on rental income from their properties to qualify for their next investment.

- Gig Economy Professionals: Think freelancers, consultants, and contractors. Their monthly income can fluctuate, which doesn't fit the predictable pattern lenders want to see.

- High-Net-Worth Individuals: Some borrowers have significant assets but don't draw a large traditional salary.

A More Flexible Path Forward

This is the exact gap that a Non-Qualified Mortgage (Non-QM) was created to fill. A Non-QM loan operates outside of the rigid government rules that conventional mortgages have to follow. This freedom gives lenders the flexibility to use other, more sensible methods to verify your income and see your true financial picture.

A Non-QM loan isn’t a subprime product; it’s a prime solution for borrowers with non-traditional financial profiles. It allows for a common-sense approach to underwriting, looking at the bigger picture of your ability to repay.

At Residential Acceptance Corporation (RAC Mortgage), these flexible financing options are our specialty. We get it—a tax return doesn't tell your whole story. By looking at things like your bank statements, asset levels, or even a property's income potential, we can see the financial strength that others miss. This opens up a clear, hopeful path to securing the home you deserve in Tampa's competitive market.

Understanding the Non-QM Mortgage Advantage

Think of a traditional mortgage as an off-the-rack suit. It fits a lot of people reasonably well, but it's almost never a perfect match. A Non-QM mortgage, on the other hand, is like getting that suit custom-tailored—it's designed from the ground up to fit your unique financial situation.

The term Non-Qualified Mortgage simply means the loan operates outside the strict, government-defined rules of conventional loans. This isn't a red flag; it's a feature. This built-in flexibility allows a specialized lender to apply common-sense underwriting to your application.

Instead of getting stuck on traditional income verification like W-2s and tax returns, a lender can look at other strong financial indicators to see your true ability to repay a loan. As a dedicated Tampa non-QM mortgage lender, we have the freedom to look at the bigger picture.

The Power of Flexible Underwriting

Common-sense underwriting is really the heart of the non-QM advantage. It lets lenders evaluate a borrower's complete financial health instead of just checking boxes on a rigid form. This approach is a lifesaver for people whose income doesn't follow a straight and narrow path.

For example, a self-employed business owner in Tampa might have fantastic cash flow but show a lower net income on their tax returns because of legitimate business write-offs. We can use a bank statement analysis to verify their actual income, a solution that opens doors to homeownership that would otherwise be closed. You can dive deeper into the specific paperwork needed by exploring our guide on non-QM loan requirements.

This kind of flexibility is more important than ever, especially here in Florida where recent regulatory shifts have created a real need for alternative financing.

Florida's real estate market has seen a notable shift in mortgage lending following the introduction of stricter condo lending rules after the 2021 Surfside building collapse. The Florida Building Safety Act now means more than 1,400 condominium buildings across the state have been flagged as ineligible for traditional, government-backed mortgages, forcing buyers to seek alternative financing solutions.

This change alone has dramatically increased the demand for non-QM lenders who can step in and provide financing when traditional options are off the table.

Who Benefits from This Approach?

The non-QM advantage isn't for just one type of borrower. It's a powerful tool for a diverse group of financially sound individuals who just don't fit into the conventional lending box.

Some of the key people who benefit include:

- Real Estate Investors: They can qualify for loans based on a property's potential rental income, not just their personal W-2 earnings.

- Foreign Nationals: International buyers looking to invest in Tampa's property market often lack a U.S. credit history, making non-QM a perfect fit.

- Borrowers with Recent Credit Events: People who have recovered from a past financial hiccup, like a bankruptcy or foreclosure, can get a loan by demonstrating their renewed financial stability.

Ultimately, this flexible approach allows us to serve more of the Tampa community. It provides a clear and accessible path to homeownership for good borrowers who are unfairly overlooked by outdated lending standards.

Who Benefits from a Tampa Non-QM Loan?

Let's be clear: Non-QM loans aren't some obscure product for just a handful of people. They are a critical financial tool for a growing wave of successful Tampa residents whose stories just don't fit into the rigid, one-size-fits-all box that conventional lenders use.

Think about the successful business owner over in Ybor City. She’s poured her heart and soul into building a company from scratch, becoming a master at reinvesting profits and using smart tax write-offs. While that's just good business, it can make her on-paper income look smaller, often leading to a 'no' from traditional banks. This is exactly where a Tampa non-qm mortgage lender like Residential Acceptance Corporation (RAC Mortgage) comes into the picture.

Solutions for Tampa's Self-Employed and Investors

For the self-employed crowd, our Bank Statement Loan is a complete game-changer. Instead of getting bogged down by tax returns, we look at 12 or 24 months of business bank statements to see the real cash flow. It’s a common-sense approach that lets their true financial strength do the talking. You can get a deeper dive into how this works on our page for https://www.racmortgage.com/self-employed-home-loans-tampa/.

Then you have the sharp real estate investors buying up properties in Seminole Heights or South Tampa. They might not have a W-2, but they’ve built a portfolio of rentals that brings in steady income month after month.

A Non-QM loan, specifically a DSCR loan, is built for real estate investors. It allows them to qualify based on the property's rental income, not their personal tax returns. If the property's cash flow covers the mortgage, they're on the path to approval.

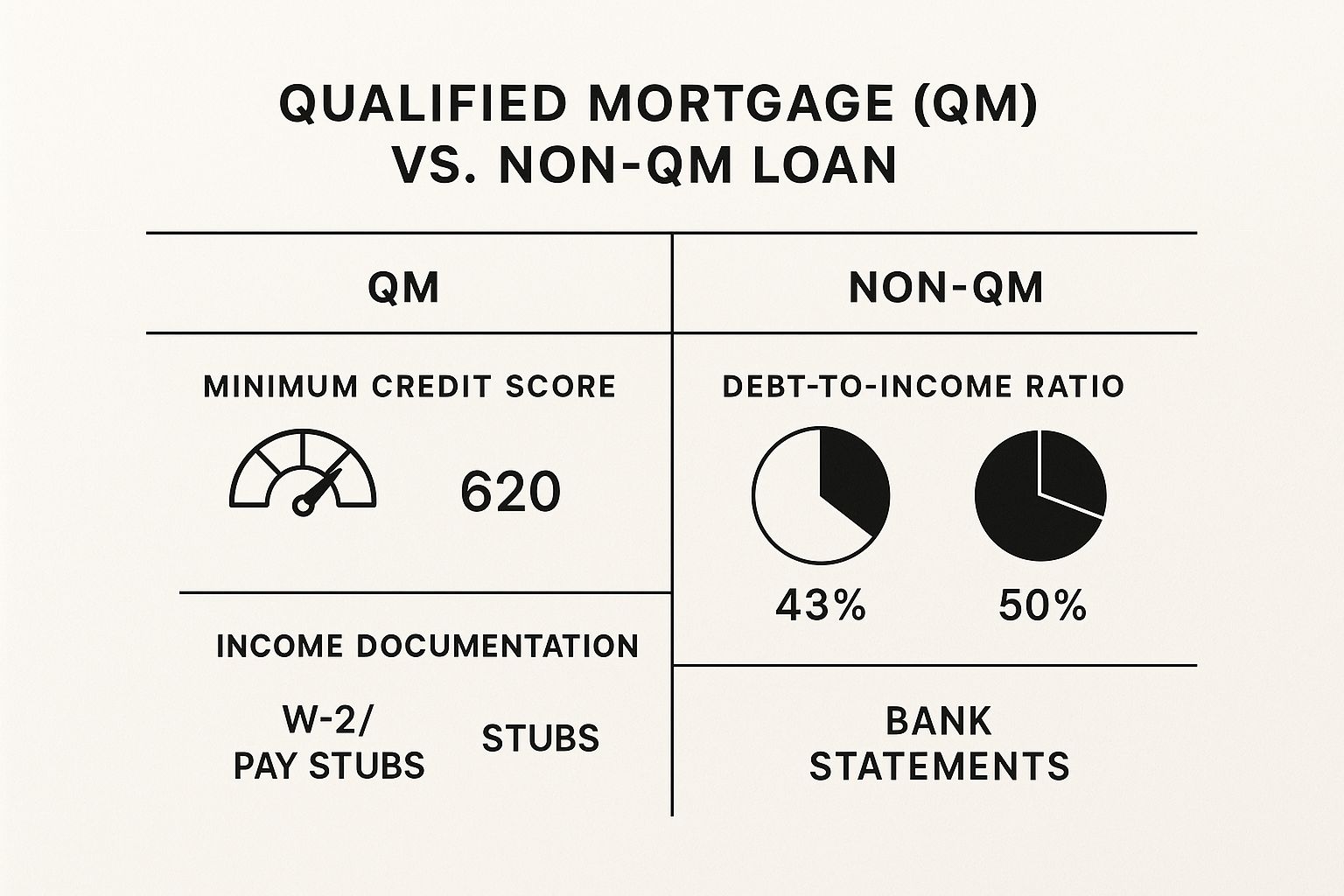

This infographic breaks down the key differences between the flexible world of Non-QM and the tighter standards of conventional QM loans.

As you can see, Non-QM loans open doors by being more accommodating on credit scores, allowing for higher debt-to-income ratios, and accepting alternative proof of income, like bank statements.

Matching Tampa Borrowers with the Right Non-QM Loan

Every borrower's situation is unique, especially in a dynamic market like Tampa. That's why we don't offer a single solution, but a range of them designed to fit specific needs. Here’s a quick look at how we match common borrower profiles with the right Non-QM loan.

| Borrower Profile | Primary Financial Challenge | Ideal RAC Mortgage Solution |

|---|---|---|

| Tampa Small Business Owner | Tax returns show low net income due to business write-offs. | Bank Statement Loan |

| Real Estate Investor | W-2 income is low or non-existent; income comes from rental properties. | DSCR (Debt Service Coverage Ratio) Loan |

| Gig Economy Worker/Freelancer | Income is inconsistent and fluctuates month-to-month. | 1099 Income Loan or Bank Statement Loan |

| Foreign National Investor | Lacks a U.S. credit history or Social Security Number. | Foreign National Loan |

This approach ensures we're not trying to fit a square peg in a round hole. Instead, we find the right tool for the job, making homeownership and investment possible for more people.

Meeting Diverse Financial Needs

The flexibility of Non-QM loans extends far beyond just business owners and investors. We see all sorts of situations in the Tampa Bay area where these loans make all the difference:

- Gig Economy Professionals: Think freelancers, consultants, and contractors. Their income often comes in waves, not the steady, predictable paycheck that traditional lenders want to see. A Non-QM loan can handle that kind of income variability.

- Foreign Nationals: Tampa is a global destination, attracting buyers from all over the world. These folks often don't have a U.S. credit history, making our Foreign National Loan the perfect bridge to owning property here.

If you're an investor, you'll find our non-QM options especially powerful. For an even broader look at financing strategies, this comprehensive guide to real estate investor financing is a great resource. By looking at the complete financial picture, RAC Mortgage can help a much wider range of deserving Tampa residents achieve their goals.

A Closer Look at Our Custom Non-QM Loan Programs

Here at Residential Acceptance Corporation (RAC Mortgage), we know that no two borrowers are alike. Your financial story is unique, and your mortgage should be too. That's why we've developed a flexible lineup of non-QM loan programs, with each one designed to solve a different kind of financing puzzle for Tampa's homebuyers and investors.

These aren't cookie-cutter loans. Think of them as specialized tools, each crafted to handle a specific income or employment situation.

Our process always starts with listening. We want to understand your circumstances first so we can match you with the program that actually makes sense for your life. Whether you're a driven entrepreneur, a real estate investor building a portfolio, or someone with significant assets, we have a solution. As a top Tampa non-qm mortgage lender, our real skill is finding the right key to unlock your homeownership dreams.

Bank Statement Loans for the Self-Employed

Tampa is full of entrepreneurs and small business owners. If that's you, you know that traditional income verification can be a massive roadblock. Your tax returns, full of legitimate business write-offs, almost never reflect your true, day-to-day cash flow.

This is exactly where our Bank Statement Loan program comes in. It's a game-changer.

Instead of getting hung up on tax documents, we look at what really matters: your cash flow. We analyze 12 or 24 months of your personal or business bank statements to get a clear picture of your consistent deposits. From there, we can calculate a qualifying income based on the real money moving through your accounts. It's just a common-sense way to prove you're financially solid when tax returns don't tell the whole story.

DSCR Loans for Real Estate Investors

The Tampa real estate market is a hot spot for investors, but trying to qualify for multiple properties using your personal income gets tough, fast. Our Debt Service Coverage Ratio (DSCR) Loan was built from the ground up for investors.

A DSCR loan completely changes the focus. It’s all about the investment property’s potential, not your personal W-2s or tax returns. The logic is beautifully simple: if the property's expected rental income can cover the mortgage and other bills, it qualifies.

The DSCR is calculated by dividing the property’s gross rental income by its total housing payment (Principal, Interest, Taxes, and Insurance). A ratio of 1.0 or higher is the magic number, showing that the property can pay for itself and is a sound investment from a lender's point of view.

This is an incredibly powerful tool that lets investors grow their portfolios based on the performance of their assets, taking personal income out of the equation.

Asset Depletion and Foreign National Loans

Our dedication to flexible financing doesn't stop there. We have solutions for other unique borrowers, too. For instance, high-net-worth individuals with plenty of liquid assets but lower reported income can tap into our Asset Depletion Loans. This program lets us convert a portion of your eligible assets—stocks, retirement funds, bonds—into a qualifying income stream.

We also embrace Tampa's international appeal with our Foreign National Loans. These are built for buyers from around the world who want to invest in our amazing property market but may not have a U.S. credit history or Social Security number.

While Tampa's home values have cooled off a bit, the market is still a stable and appealing place to invest. With recent stricter condo lending rules making a lot of Florida's condo inventory ineligible for standard financing, non-QM lenders are stepping in to fill that gap with smart, asset-based solutions. You can learn more about how our alternative documentation mortgages are providing crucial financing options in today's market.

Our No-Fuss Non-QM Application Process

Getting a non-traditional loan shouldn't be a nightmare. At Residential Acceptance Corporation (RAC Mortgage), we think the path to your non-QM mortgage ought to be clear and simple. We’ve built our process to cut through the confusion, making sure you know exactly what’s happening at every turn.

Our whole approach is built around you and your unique financial story. As a leading Tampa non-qm mortgage lender, we know a one-size-fits-all application just doesn't cut it for today's homebuyers and investors.

The Initial Consultation

It all starts with a conversation, not an interrogation. When we first chat, our main job is just to listen. We want to hear about your goals for buying a home or investing, understand your financial journey, and learn what brought you to us in the first place. This is where we lay the groundwork for a solid plan.

This first step is huge because it lets us figure out the best way forward. We'll talk about which non-QM program—whether it's a Bank Statement loan, DSCR, or something else—makes the most sense for you and set clear expectations right from the get-go.

Simplified Document Gathering

Next up is getting the paperwork together, but we do it differently. We only ask for what actually matters for your loan. You can forget about the mountains of random forms you see with traditional mortgages.

We simplify things by focusing only on the documents that best prove you can repay the loan. It's all about being efficient and relevant, not drowning you in paperwork.

We’ll walk you through exactly what we need, which might be:

- 12 or 24 months of bank statements to see your cash flow.

- Asset verification documents if you're using an asset depletion loan.

- Property income projections for a DSCR loan.

Common-Sense Underwriting and Closing

Once we have your documents, our in-house underwriting team gets to work. These aren't just number-crunchers running things through a computer; they look at your whole financial picture with a common-sense approach, actively looking for reasons to say "yes."

From there, we give you a clear approval and guide you through closing. Our team keeps the lines of communication wide open, so you'll understand every detail and feel confident from that first phone call all the way to the final signature.

Why Choose RAC Mortgage in Tampa

Picking a mortgage lender isn’t just about comparing interest rates. It's about finding a real partner who gets what you're trying to achieve. As a dedicated Tampa non-QM mortgage lender, we at Residential Acceptance Corporation (RAC Mortgage) put people way ahead of paperwork. We’ve thrown the rigid, one-size-fits-all approach out the window.

Instead, we take the time to actually listen and understand your unique financial story. Our real strength comes from our deep knowledge of the local Tampa market, a wide range of loan products, and a genuine commitment to finding a way to get our clients to a "yes."

A Partner in Your Homeownership Journey

In a market as vibrant as Tampa, you need flexibility. It’s essential. Recent data has shown a local uptick in mortgage delinquencies, which really just shines a spotlight on the need for more adaptable financing options that go beyond the standard conventional loan. You can read more about how these local market trends affect mortgages. This is exactly where RAC Mortgage comes in, ready to serve this growing need with options that truly make sense.

Partnering with RAC Mortgage means you're working with a team that sees you as a person with a story, not just a number on a credit report. Our mission is to help you finally achieve your dream of owning a home right here in Tampa.

We’ve built our reputation in Tampa on trust and happy clients. We know that boosting referral volume is about more than just a business tactic; it’s the result of doing right by people. Our goal is to build lasting relationships, making sure you feel supported from our very first chat all the way to closing day—and even after you get the keys.

Got Questions About Non-QM Loans? We've Got Answers.

Stepping into the world of non-traditional financing can feel like uncharted territory, and it's only natural to have a few questions. As a dedicated Tampa non-QM mortgage lender, we're all about making things clear and straightforward so you can move forward feeling completely in control. Here are some of the most common things we hear from borrowers just like you.

How Long Do I Need to Be Self-Employed to Qualify?

Generally, we want to see at least a two-year track record of self-employment. We typically confirm this by looking at your federal tax returns, which gives us a solid picture of your business's stability and success over time.

While two years is the gold standard, it's not always a hard and fast rule. If you have other strong points in your favor—like a fantastic credit score or a hefty amount in savings—we can sometimes make exceptions.

How Do You Figure Out My Qualifying Income?

For self-employed folks, we usually calculate your qualifying income by averaging the net income from your last 12 or 24 months of tax returns. We're looking at the adjusted gross income after you've taken all your business deductions.

This averaging approach is great because it smooths out the typical ups and downs that come with running your own business. A steady upward trend in your income always looks great, but if there's been a dip, a simple explanation is usually all that's needed.

Will Taking a Ton of Business Deductions Hurt My Chances?

This is a big one we hear all the time. Being smart about business write-offs is great for your tax bill, but it does lower the net income we use to qualify you for a loan. It doesn't mean you're out of the running, but it might reduce the total loan amount you can get approved for.

This is exactly where a Bank Statement loan comes into play. Here at Residential Acceptance Corporation (RAC Mortgage), we can use this program to look at your actual cash flow from your bank statements instead of what your tax returns show.

What Exactly Is a Bank Statement Loan?

A bank statement loan is one of the most popular non-QM options out there, built specifically for self-employed borrowers. Instead of digging through tax documents, we analyze 12 or 24 months of deposits into your personal or business bank accounts to determine your qualifying income.

It’s a common-sense alternative that lets us see your true financial picture, especially when your tax returns don't tell the whole story.

Ready to see how a more flexible approach to homeownership in Tampa could work for you? The team at Residential Acceptance Corporation is here to listen to your story and find the non-QM loan that fits your life.