If you're self-employed in Tampa, you know the drill. Trying to get a traditional mortgage can feel like you’re being punished for running a smart business. A stated income mortgage in Tampa is the answer, giving entrepreneurs like you a way to finance a home based on your real cash flow, not just what's on your tax returns. With a modern, compliant bank statement loan from Residential Acceptance Corporation (RAC Mortgage), you can finally get credit for the money you actually make and compete in Tampa's hot housing market.

Your Path to a Tampa Home with a Stated Income Mortgage

For so many successful Tampa entrepreneurs, a standard mortgage application just doesn't make sense. It’s like trying to fit a square peg into a round hole. Lenders ask for W-2s and tax returns, but those documents often tell a misleading story for a business owner who uses legitimate write-offs to lower their taxable income.

This is exactly where a stated income mortgage—often called a bank statement loan—opens up a much clearer path to owning a home. Instead of nitpicking your tax returns, this type of loan looks at the actual cash flowing through your business.

At Residential Acceptance Corporation (RAC Mortgage), this is our specialty. We get it. The consistent deposits hitting your bank accounts month after month are the true measure of your financial strength. Forget the risky "no-doc" loans from the past; this is a fully compliant, modern solution that follows today's strict lending rules.

Key Differences in Verification

The real game-changer is the paperwork. While a traditional loan is obsessed with tax returns, a stated income mortgage focuses on a completely different set of documents.

- Traditional Approach: Lenders zero in on your Adjusted Gross Income (AGI)—the number left after all your business expenses and deductions.

- Stated Income Approach: We look at 12 to 24 months of your business or personal bank statements to see your consistent deposits and calculate a qualifying income from there.

That single difference is everything for business owners, gig workers, and consultants in the Tampa Bay area. It means your hard-earned revenue is what actually matters, not just what’s left on paper after your accountant works their magic.

To make it even clearer, let's put the two loan types head-to-head. The table below breaks down the main differences in how your income is verified and shows you who each loan is really built for. You'll quickly see why a stated income mortgage in Tampa might just be the perfect tool for your entrepreneurial journey.

Stated Income Mortgage vs Traditional Mortgage at a Glance

| Feature | Stated Income Mortgage (RAC Mortgage) | Traditional Mortgage |

|---|---|---|

| Income Verification | Based on 12-24 months of bank statement deposits to show consistent cash flow. | Based on W-2s, pay stubs, and federal tax returns (AGI). |

| Ideal Borrower Profile | Self-employed individuals, business owners, freelancers, and contractors with substantial but complex income streams. | Salaried or hourly employees with predictable, easily documented W-2 income. |

| Document Focus | Proof of consistent business revenue and cash flow. | Proof of taxable income after deductions and write-offs. |

As you can see, it's not about which loan is "better," but which one is built for your financial reality. For the W-2 employee, a traditional mortgage is a straight shot. But for the entrepreneur, the stated income loan is designed to recognize and reward your success.

How a Modern Stated Income Mortgage Actually Works

To really get what a modern stated income mortgage in Tampa is all about, you have to shift your thinking. A traditional mortgage is just a snapshot. It freezes a single moment in time—your W-2 or tax return—and judges your entire financial life based on that one picture. For any entrepreneur, that snapshot completely misses the real story.

Think of a stated income loan as the full-length feature film. We look at 12 to 24 months of your bank statements to see the whole narrative of your business's cash flow. Here at Residential Acceptance Corporation (RAC Mortgage), we’re focused on that bigger picture. We want to see the actual revenue your business brings in, month after month.

It's a common-sense approach that allows us to see your true financial strength, not just what's left after you've written off every possible business expense. This is lending designed for the real world of self-employment.

The Ability-to-Repay Rule Is Key

Let's clear up a huge misconception right away. These aren't the wild, risky "no-doc" loans from back in the day. Not even close. Today’s lending world is buttoned up with strict federal regulations, and the most important one is the Ability-to-Repay (ATR) rule.

This rule is a non-negotiable backstop. It legally requires lenders like us to make a solid, good-faith determination that you can actually afford your mortgage payments. We don't just take your word for it; we verify everything using alternative documents that are just as valid as a pay stub.

We’re not looking at a single tax form. Instead, we’re analyzing a long-term pattern of deposits. This gives us a reliable and fully compliant way to prove your income and satisfy the ATR rule, making sure the loan is a responsible and safe fit for you.

How We Calculate Your Qualifying Income

The process for figuring out your income from bank statements is methodical and completely transparent. We aren't just glancing at the final balance. Our underwriting team meticulously goes through your deposits to establish a consistent, dependable monthly income figure we can stand behind.

Here’s what that looks like:

- Reviewing Deposits: We comb through your bank statements, usually for a 12 or 24-month period, to identify all the regular, business-related income.

- Applying an Expense Factor: To account for the costs of running your business, we may apply a standard expense factor to your total deposits. This gives us a realistic qualifying income number.

- Creating a Full Picture: We then combine this verified income with your other financial details, like your credit score and any assets you have, to build a comprehensive and accurate picture of your ability to handle a mortgage.

This detail-oriented, documentation-heavy process is exactly what makes a modern stated income mortgage in Tampa a secure and legitimate financing option.

For entrepreneurs who just need a lender to see their finances the way they do, learning more about how a bank statement mortgage in Tampa works is the smartest next step you can take. It’s a system built for people who broke the 9-to-5 mold.

The Evolution from Risky Loans to Reliable Mortgages

To really understand how safe a modern stated income mortgage in Tampa is, you have to look back at where it came from. The name itself still carries some baggage from the past, and knowing how much things have changed is the first step to feeling confident about this financing option.

Let's rewind to the housing boom of the early 2000s. Back then, the market was swimming in what people called "no-doc" or even "liar loans." These mortgages asked for little to no proof of income, creating a house of cards that was destined to collapse.

And it did. These loosely regulated loans were a huge factor in the 2008 financial crisis. Stated income mortgages were labeled a “clear culprit” in the wave of defaults that hammered fast-growing markets like Tampa, leading to a flood of foreclosures. For a deeper dive, this Federal Reserve analysis shows just how much lending practices affected different regions.

The Shift to Safer Lending Standards

The crash forced a total reset of the mortgage industry. Lawmakers stepped in with massive reforms, most importantly the Dodd-Frank Act, which set a new, non-negotiable rulebook for every lender in the country.

This was a game-changer. It built a strong consumer protection framework and, crucially, gave us the Ability-to-Repay (ATR) rule. This one federal rule single-handedly ended the era of "no-doc" lending for good.

Today, every lender—including us here at Residential Acceptance Corporation (RAC Mortgage)—is legally required to make a genuine, good-faith effort to verify that a borrower can actually afford their loan. This is what separates today's safe, compliant stated income loans from their sketchy ancestors.

The modern stated income mortgage is a completely different animal. It's not a "no-doc" loan; it's an "alt-doc" loan. We simply use different—but just as valid—documents, like bank statements, to prove your income and ensure the loan is solid for both you and the lender.

How RAC Mortgage Ensures a Secure Loan

At RAC Mortgage, we don't just follow these strict standards; we embrace them. Our entire process for a stated income mortgage in Tampa is built around thorough documentation and responsible underwriting. We never just take a number at face value—we verify it.

Here’s a look at how we build a loan you can count on:

- Comprehensive Documentation: We ask for 12 to 24 months of bank statements. This gives us a crystal-clear picture of your actual, consistent cash flow.

- Methodical Analysis: Our underwriters dig into those statements, analyzing deposits to calculate a dependable qualifying income. This ensures your mortgage payment is truly manageable.

- Full ATR Compliance: Every single loan we write is fully compliant with the Ability-to-Repay rule. It's a critical layer of security that gives everyone peace of mind.

This journey from a high-risk gamble to a highly regulated, secure product is a big deal. For Tampa's entrepreneurs, gig workers, and self-employed pros, it means you can finally get fair financing that understands your real income, without cutting corners on safety.

Is a Stated Income Loan Right for You?

A stated income loan isn't some magic bullet for every homebuyer, but for the right Tampa entrepreneur, it’s an absolute game-changer. These mortgages are built from the ground up for people whose financial reality just doesn't fit into the neat, tidy boxes of a traditional loan application.

So, who is the perfect candidate? Let’s paint a picture of who really thrives with a stated income mortgage in Tampa. Think about a successful restaurant owner in South Tampa. Her place is always packed, cash flow is fantastic, and her bank deposits are strong and consistent. But her tax returns tell a different story—a much lower net income after factoring in food costs, payroll, and equipment depreciation. These are all perfectly legal, smart business write-offs.

When she goes to a traditional bank for a mortgage, they only see that lower number on her tax return and immediately deny her, completely ignoring the fact that her business brings in millions in revenue. This is exactly where the traditional system breaks down for entrepreneurs.

Real-World Tampa Scenarios

This story is incredibly common all across the Bay Area. The unique economic fabric of our city is woven with self-starters who hit the exact same roadblock.

Take a look at these other real-world examples:

- The Ybor City Web Developer: She’s a freelance developer who lands high-value projects, causing her income to swing month to month. One month she might deposit $25,000, and the next it's $8,000. A traditional lender gets spooked and calls this "instability." We look at the 24-month pattern and see strong, consistent annual earnings.

- The St. Pete General Contractor: He's constantly investing back into his business, buying new trucks and tools. These massive capital expenditures slash his taxable income, yet his bank statements clearly show a thriving, cash-healthy operation that’s growing year after year.

In both of these cases, the borrower is a financial success and is more than capable of handling a mortgage payment. The problem isn't their ability to pay—it's the paperwork they're forced to provide.

A stated income mortgage from Residential Acceptance Corporation (RAC Mortgage) bridges this gap. We analyze your actual bank deposits—the true story of your income—to build a logical and clear path to approval that a traditional lender simply can't see.

Is This Your Story?

If you see yourself in any of these scenarios, a stated income loan might be the key to your homeownership journey. It’s a product built for the business owner whose success is better measured by cash flow, not by their final tax liability.

For so many Tampa entrepreneurs, this is the loan that finally unlocks the door to homeownership in a tough market. If you want to dig deeper into the specific documents and qualifications needed, our detailed guide on self-employed home loans in Tampa will give you even more clarity. When you work with a lender who actually understands your world, you get the credit you deserve for the business you’ve built.

What to Expect in the Application Process

Trying to get a non-traditional mortgage can feel like you're navigating a maze, but the path to securing a stated income mortgage in Tampa is actually pretty straightforward once you know the steps. At Residential Acceptance Corporation (RAC Mortgage), we’ve laid out a clear, simple process for entrepreneurs, so you feel in control from the first handshake to the final signature.

It all starts with a simple conversation.

This initial chat is absolutely essential. It’s where we sit down and really listen to understand your specific financial picture and what you’re hoping to achieve. Think of it as a strategy session where we make sure a bank statement loan is the perfect tool for your situation before we go any further.

We believe in total transparency, which is something Tampa’s self-employed community really needs from a lender who gets their world.

Gathering Your Financial Story

After we've mapped out your goals, it's time to gather the documents. This is the biggest difference between a stated income mortgage and a conventional loan. Instead of digging through old tax returns and W-2s, your bank statements are what tell the real story of your income.

We'll walk you through exactly what documents are needed for your mortgage, but the foundation of your application will typically be built on these items:

- Bank Statements: You'll usually need 12 to 24 months of business or personal bank statements. This gives us a clear picture of your consistent deposit history.

- Identification: Just the standard proof of who you are, same as any other home loan.

- Business Documentation: In some cases, you might need to provide a Profit & Loss (P&L) statement that you or your accountant put together.

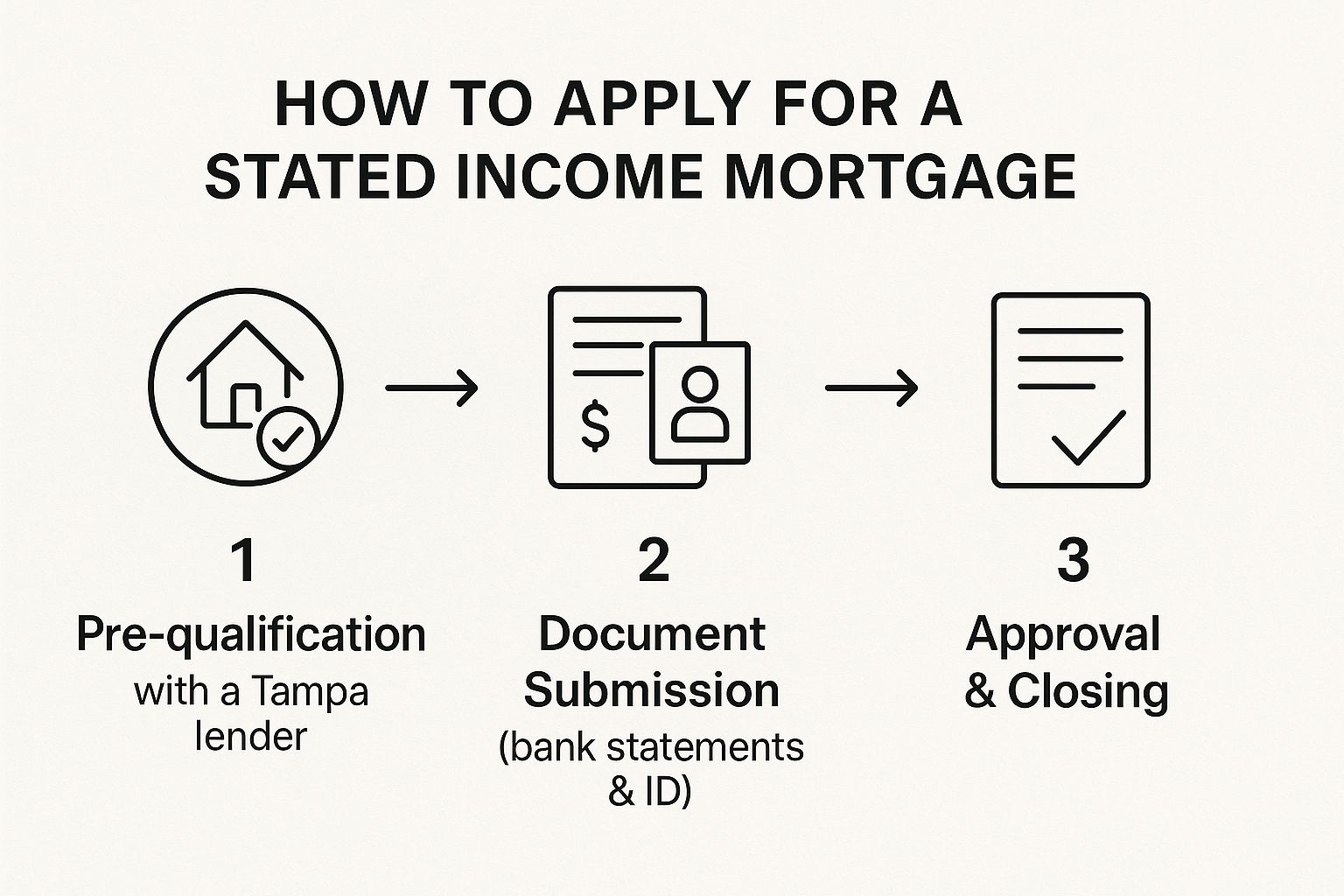

This visual breaks down the key stages of the journey.

As you can see, we're focused on proving your income with real-world cash flow, not tax paperwork. It’s a game-changer for business owners.

Underwriting, Approval, and Closing

Next up is underwriting. This is where our team of specialists rolls up their sleeves and analyzes your bank statements to figure out your qualifying income. We comb through your deposits to build a solid, logical case that shows you can comfortably handle the loan. Our team lives and breathes this kind of analysis, so we cut through the confusion that traditional lenders often create.

The goal is to provide a smooth and predictable experience. Because we specialize in helping Tampa's self-employed borrowers, our team offers expert guidance at every stage, building your confidence as we move toward the finish line.

Once you get the green light, we coordinate with everyone involved to get your closing on the calendar. We make sure you understand every last detail, making that final step into homeownership a completely seamless experience. The entire process is built to be approachable and clear, giving you the support you deserve.

Thriving in the Tampa Real Estate Market

Tampa’s real estate market is hot. It’s competitive, fast-moving, and a perfect mirror of the city's explosive economic growth. For the entrepreneurs and self-employed pros driving that boom, having access to quick, commonsense financing isn’t just a nice-to-have—it's what gets the deal done.

This is exactly where a stated income mortgage in Tampa comes into play. When the right property hits the market, you don’t have time to wait around. A typical conventional loan application can get completely bogged down in tax returns and W-2s, leaving you watching from the sidelines as another buyer snaps up your dream home.

A bank statement loan from Residential Acceptance Corporation (RAC Mortgage) completely flips that script. We focus on your real-world cash flow, not just what your tax documents say. This lets us move much faster, giving you the power to make a strong offer and win in this seller's market.

Overcoming Affordability Hurdles

Let's be honest: even with all its growth, Tampa can be a tough market to afford. Data from early 2025 shows that between rising interest rates and climbing home prices, a lot of buyers are feeling the squeeze. And while today’s lending rules are much safer than they used to be, they can be incredibly rigid for anyone with non-traditional income.

This makes income verification a massive roadblock for many qualified borrowers. You can get a closer look at these market trends by reviewing key mortgage monitoring findings. This is precisely why stated income mortgages are so important. They offer a legitimate, reliable path to homeownership for entrepreneurs who might otherwise be shut out of the market entirely.

A stated income loan from RAC Mortgage isn't just about getting a mortgage. It's a tool that empowers Tampa’s business owners—the engine of our local economy—to build their own wealth and invest right back into the community they’re helping to create.

It’s all about giving you a fair shot, even when the standard lending box doesn't fit your financial picture. We help you turn your business success into a real estate asset, right here in the city you call home.

Your Stated Income Mortgage Questions Answered

Jumping into the world of non-traditional home loans can feel like learning a new language. It's only natural to have a few questions. We get it. This final section is all about giving you clear, direct answers to the things we hear most often from Tampa’s self-employed pros, so you can feel confident and ready to take the next step.

Are Stated Income Mortgages Legal in Tampa Today?

Yes, absolutely. The stated income mortgages available today are 100% legal and designed with borrower safety in mind. They’re a world away from the old 'no-doc' loans that got a bad rap years ago.

Today's loans, including those from us at Residential Acceptance Corporation (RAC Mortgage), have to play by the federal 'Ability-to-Repay' rule. This means we don’t just take your word for it; we verify your income using alternative documents like bank statements to make sure the loan is something you can comfortably afford. It’s a much more responsible way to get you financed.

After the 2008 crash, the government rolled out big reforms like the 2010 Dodd-Frank Act, which put strict income verification rules in place to keep the old problems from happening again. You can still see the shadow of those risky old loans in places that got hit hard, and Tampa was one of them, seeing some of the highest foreclosure rates in the country from 2009-2011. If you're curious, you can discover more about these mortgage market impacts to see just how much safer today's rules have made things for everyone.

What Documents Will I Need to Apply?

Forget about digging up old tax returns and W-2s. For a stated income loan, we're looking at what your business is actually doing.

You’ll typically need to provide 12 to 24 months of personal or business bank statements. A profit and loss (P&L) statement prepared by you or your accountant might also be needed. The whole point is to build a real-time picture of your cash flow to figure out an income we can use to qualify you for the loan.

This approach lets us see the true financial health of your business. We focus on consistent revenue, not just the taxable income figure that so often holds entrepreneurs back with traditional banks.

Do I Need a Higher Credit Score and Down Payment?

In most cases, yes. Because these aren't your standard cookie-cutter loans, we at RAC Mortgage need to see other signs of financial strength to balance out the risk.

Think of it as showing your financial stability in other ways. This usually means bringing two things to the table:

- A solid credit score, often 680 or higher.

- A larger down payment, typically 20% or more.

When you meet these criteria, you're demonstrating your commitment and financial discipline. It makes your application much stronger and really smooths the path to closing on your new Tampa home. It’s a huge part of what makes a modern stated income mortgage in Tampa such a secure and reliable option for people running their own show.

Ready to see how your real income can get you into your dream home in Tampa? The expert team at Residential Acceptance Corporation specializes in helping self-employed borrowers navigate this process with confidence. Apply online today and take the first step.