Trying to buy a home in Tampa with a less-than-perfect credit score can feel like an uphill battle. But I'm here to tell you it's not just possible—it's something we help people do every single day. The secret isn't some magic trick; it's about finding the right partner. You need a specialized low credit mortgage lender in Tampa who sees you as a person, not just a number.

That’s where Residential Acceptance Corporation (RAC Mortgage) comes in. We built our business to help the very people who get turned away by big banks and their rigid, automated approval systems.

Getting a Tampa Mortgage When Your Credit Isn't Perfect

Let’s be real. Navigating the Tampa housing market is tough enough, but when you add a few credit dings to the mix, it can feel downright discouraging. The market is competitive, home prices keep climbing, and it's easy to feel like you're being locked out.

Many would-be homeowners get hit with a quick "no" from conventional lenders. Their systems are built to rubber-stamp perfect applications and reject everything else. We take a completely different approach because we know life happens. A medical emergency, a layoff, or some other unexpected event shouldn't stop you from owning a home.

Here’s how we look at things differently:

- We see the whole you. Your FICO score is just one part of your story. We want to understand your income, your work history, and what’s behind any credit issues you've had.

- We know the right loan programs. We live and breathe the loan options designed for buyers who don't fit the traditional mold. This opens up more pathways to getting you approved.

- We’re local. We're not some faceless national company. We're right here in the Tampa Bay area, and we understand the unique pressures of this market.

Feeling the Squeeze in the Local Market

The Tampa housing market has its own set of challenges. We're seeing more local homeowners facing financial stress. For example, as of November 2024, the mortgage delinquency rate in Tampa Bay was around 5.5% for loans 30+ days past due. That’s a pretty big jump from 3.3% just a year earlier.

This trend shows just how important it is to have a lender who gets the local economic climate and can help you build a loan application that's solid and resilient.

This guide is more than just generic advice. We’re giving you a clear, step-by-step roadmap to strengthen your finances and get to the closing table with a lender who is actually on your team.

Instead of feeling stuck, it's time to take control. We'll show you how to put together a powerful application that highlights your strengths. You can learn more about our specific approach to Tampa home loans for bad credit and see how we can help you make your homeownership dream come true.

Why a Specialized Lender Is Your Greatest Asset

In Tampa's bustling housing market, the mortgage partner you choose can make or break your deal, especially when your credit has a few dings. Big, conventional lenders often run on autopilot. Their systems are built to check boxes, and if your credit score doesn't fit neatly into their predetermined criteria, it’s an automatic "no." There's no room for your story.

That’s where a specialized low credit mortgage lender in Tampa changes the game. Here at Residential Acceptance Corporation (RAC Mortgage), we look at the person, not just the number. We know that a past financial stumble doesn't mean you can't be a fantastic homeowner today. Our entire process is built around a real, human evaluation of your finances—from your steady income to the positive steps you’ve been taking lately.

Navigating Tampa’s Unique Market Dynamics

Tampa is growing fast, and that creates a unique mix of opportunities and hurdles for homebuyers. The city is a magnet for new residents, which keeps housing demand sky-high for everyone, including those who don't have perfect credit. This kind of local economic climate demands a lender who actually understands what’s happening on the ground.

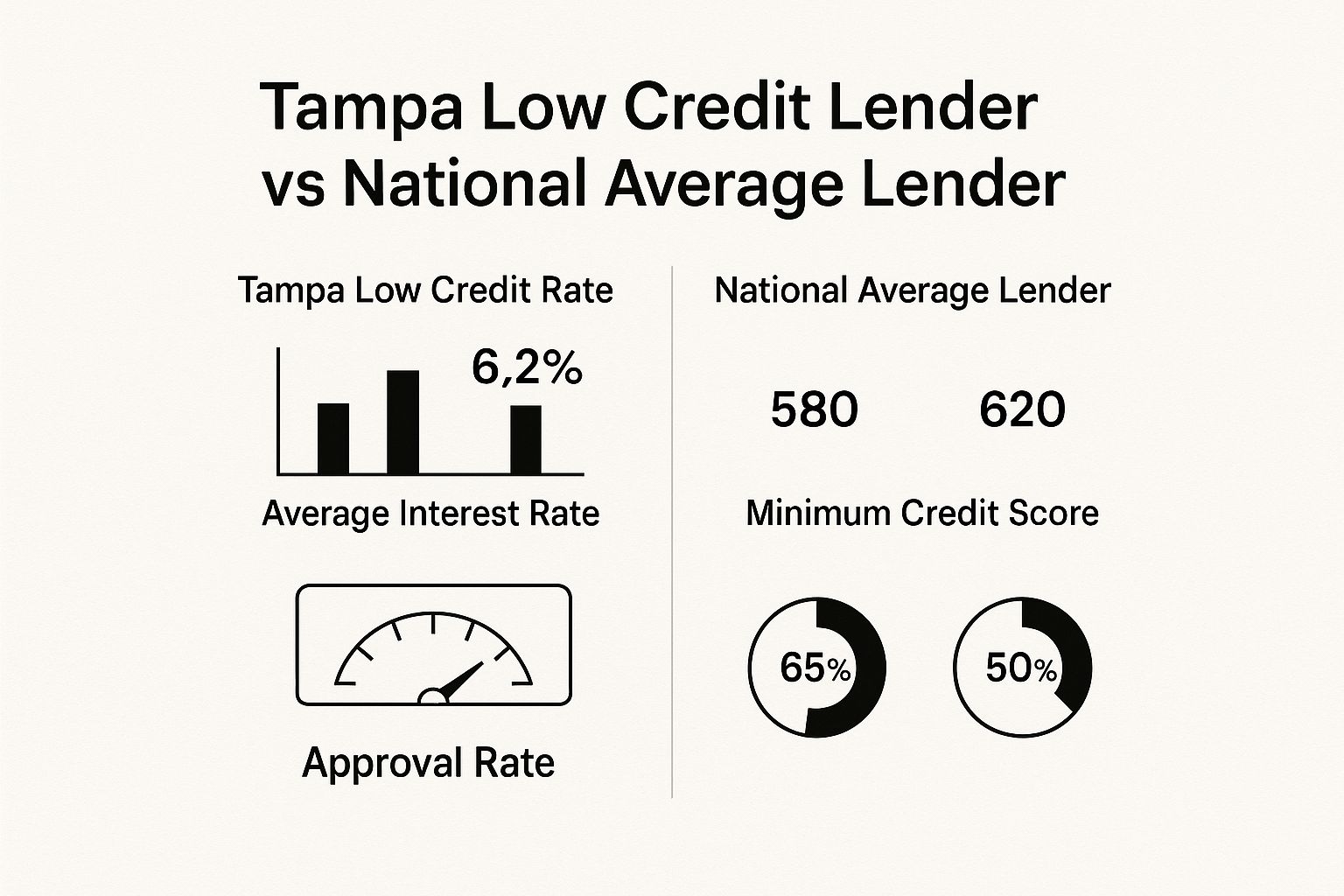

This breakdown shows just how different the experience can be when you work with a local specialist versus a national lender who sees Tampa as just another pin on a map.

As you can see, a lender who specializes in the Tampa market can often deliver better rates, work with lower credit scores, and achieve much higher approval rates. Why? Because we get the local nuances that big banks simply miss.

At RAC Mortgage, our deep roots in the community give us an edge. We don't just see data points; we see market trends and use that insight to build mortgage solutions that are both flexible and realistic. We get that life happens, and our manual underwriting process means we can actually listen to your story and factor it into our decision.

A specialized lender doesn’t just process your application; they advocate for it. They find pathways to approval where automated systems only see roadblocks, turning a potential "no" into a "welcome home."

This is especially critical right now. As of early 2025, Tampa's population was closing in on 386,000 people and growing at an impressive 3.3% each year. This boom puts serious pressure on the housing market, making it even more important to have a lender like RAC Mortgage who offers products designed for the real people of our community. If you're interested, you can dive deeper into Tampa's demographic trends and their housing impact on graystoneig.com.

To put it into perspective, here's a side-by-side look at how a typical lender stacks up against a specialist like us.

Conventional Lender vs RAC Mortgage for Low Credit Borrowers

| Feature | Conventional Lender Approach | RAC Mortgage Approach |

|---|---|---|

| Credit Score Review | Relies on automated systems. A low score often leads to immediate rejection. | Uses manual underwriting to review the whole financial picture, not just the score. |

| Local Market Knowledge | Applies a generic, nationwide lending model that may not fit Tampa's unique market. | Deep understanding of Tampa's economy and housing trends informs lending decisions. |

| Flexibility | Rigid guidelines with little room for exceptions, regardless of individual circumstances. | Offers flexible loan programs (like FHA and VA loans) designed to help low-credit borrowers. |

| Personalization | You are often just an application number in a large queue. | We provide one-on-one guidance, treating you as a partner in the homebuying process. |

| Approval Likelihood | Lower approval rates for borrowers below the standard credit threshold. | Significantly higher chance of approval because we look for reasons to say "yes." |

Ultimately, choosing a lender who is genuinely invested in your success can be the single most important decision you make. Partnering with a specialist gives you a powerful advantage, ensuring you’re not just another file on a desk, but a future homeowner with a clear plan to get the keys.

Practical Steps to Boost Your Mortgage Readiness

Improving your credit score for a mortgage is about more than just following generic advice you find online. It's about taking specific, targeted actions that actually matter to the underwriters at a low credit mortgage lender in Tampa.

At Residential Acceptance Corporation (RAC Mortgage), we tend to focus more on your recent financial behavior than mistakes from years ago. This is great news for you, because it means the positive steps you take right now can have a huge impact on your application.

Let's move past the basics and get into the real-world strategies that build a stronger case for getting your home loan approved.

Focus on High-Impact Credit Adjustments

When you're getting ready to apply for a mortgage, not all credit improvements are created equal. Some moves carry way more weight with underwriters than others. Instead of trying to fix everything at once, it’s smarter to prioritize these high-impact areas first.

-

Strategically Pay Down Revolving Debt: A lot of people think closing old credit card accounts is a good move. It's not. Doing so can actually lower your score by reducing your total available credit. A much better strategy is to pay down your highest balances. Your credit utilization ratio—how much debt you have compared to your credit limit—makes up about 30% of your FICO score. Getting this ratio down, especially below 30%, is a powerful signal of financial stability to any lender.

-

Address Collection Accounts Thoughtfully: An old medical collection from a few years back is viewed very differently than a recent, unpaid credit card bill. Before you rush to pay off any collection, it's critical to understand the potential impact. Believe it or not, sometimes paying an old debt can "re-age" it on your report, which can temporarily ding your score. We can help you figure out which accounts to address and exactly how to document them for your application.

-

Build a Positive Payment History: This is the big one. Your payment history is the single most important factor in your score, accounting for a massive 35% of it. Even if you've had late payments in the past, putting together a flawless record of on-time payments for at least 6-12 months before you apply shows underwriters that you're reliable and trending in the right direction.

A Real-World Scenario: Medical Debt

Let me give you a common example. We recently worked with a Tampa homebuyer who had a medical emergency two years ago that resulted in a $5,000 collection account. Their score took a hit, but since then, they've maintained perfect payment records on their car loan and two credit cards. A big bank's automated system might just see the collection and spit out a denial.

At RAC Mortgage, our underwriters look deeper. We see the consistent, positive payment history since that medical event, which tells a story of recovery and responsibility. To us, that recent positive trend is often more meaningful than an isolated negative mark from the past.

By focusing on these targeted improvements, you’re not just trying to raise a number; you’re building a compelling story that shows you're ready for homeownership. For more in-depth strategies, check out our complete guide on how to improve your credit score for a mortgage.

As you get your finances in order, it's also smart to understand all the other costs that come with owning a home, like insurance. Getting a handle on things like understanding homeowners insurance policies—even specialized ones for things like solar panels—shows lenders that you're truly prepared for all the responsibilities ahead.

Building a Bulletproof Mortgage Application

A strong mortgage application does more than just list your financial data; it tells a compelling story of where you've been and, more importantly, where you're going.

When you're working with a specialized low credit mortgage lender in Tampa like us at Residential Acceptance Corporation (RAC Mortgage), a clear, well-organized file is one of the most powerful tools you have. It's not just about submitting paperwork. It’s about building a solid case for your homeownership goals.

Think of your application as your financial autobiography. We're here to give you the roadmap to write a bestseller—one that underwriters will read with confidence. This all starts with understanding the 'why' behind each document, from tax returns to bank statements.

The Story Your Bank Statements Tell

Your bank statements are way more than a simple record of transactions. They paint a vivid picture of your day-to-day financial habits.

Our underwriters look at them to confirm you have the funds for a down payment and closing costs, sure. But they're also looking for signs of financial discipline.

For example, regular, consistent deposits that line up with your stated income show stability. On the flip side, avoiding overdrafts or non-sufficient funds (NSF) fees proves you manage your cash flow responsibly. This consistency is a huge indicator that you're ready for a monthly mortgage payment.

A well-managed bank account with a clear savings pattern can often speak louder than an old credit issue. It’s tangible proof that you're prepared for the financial responsibilities of owning a home in Tampa.

Crafting a Powerful Letter of Explanation

Life happens. We get it. Sometimes your credit report reflects those unpredictable moments. A past late payment, a collection account, or a period of financial hardship doesn't have to be a dealbreaker. This is where a Letter of Explanation (LOE) becomes an essential part of your story.

An LOE provides the crucial context that a credit report just can't. It’s your chance to briefly and factually explain what happened, what steps you took to resolve it, and—most importantly—why it won't happen again.

For instance, if a medical emergency snowballed into a collection account, you can explain the circumstances and show how you've since built a solid payment history. This letter helps our underwriters at RAC Mortgage see the full picture, allowing them to make a more informed and personalized decision.

Preparing for the Tampa Market Realities

Putting together a meticulously prepared application is even more critical given the current dynamics of our local housing market.

Recent market fluctuations have seen some shifts in home values. Tampa’s housing market, for instance, has seen some adjustments. Zillow reported a 5.6% drop in home values over the previous year, with even steeper declines of 7.6% in nearby areas like St. Petersburg.

Falling property values can naturally make lenders a bit more cautious. That's precisely why a thorough, transparent application helps ease any perceived risk and builds a much stronger case for your approval. You can dig into more details about the Tampa real estate market on steadily.com.

By organizing your documents and anticipating the kinds of questions an underwriter might have, you take the mystery out of the process for yourself and present your financial situation with total clarity and confidence.

Finding the Right Loan for Your Situation

There’s no magic bullet when it comes to mortgages. The "best" loan out there is simply the one that fits your specific financial picture. When your credit isn't perfect, just understanding the different paths available is the most important step you can take.

At Residential Acceptance Corporation (RAC Mortgage), we’ve built our business on looking beyond a three-digit score. Our specialty is finding a practical way forward for Tampa homebuyers, focusing on flexible loan programs designed for people who don't fit into the rigid boxes that big banks and conventional lenders use.

This isn’t about just rattling off a list of loan types. It’s about showing you how they actually work for real people in the real world.

FHA Loans: A Lifeline for Many Homebuyers

FHA loans are easily one of the most popular routes for buyers with lower credit scores, and for good reason. Because they’re backed by the Federal Housing Administration, lenders like us can offer much more forgiving qualification standards.

That flexibility is often what makes homeownership possible. Let’s say a first-time homebuyer in Tampa has a 580 credit score. They’d likely get an instant “no” from a conventional lender. But an FHA loan could get them into a new home with as little as 3.5% down. That lower barrier to entry can be the key that finally unlocks the door.

We walk our clients through the FHA process all the time, making sure they understand the benefits as well as the requirements, like the mortgage insurance premiums (MIP) that come with the loan.

Non-QM Loans: For When Your Story is More Complex

But what if your financial situation is a bit more… unique? Maybe you're self-employed with income that swings up and down, or a recent credit hiccup is making a traditional loan impossible. This is exactly why Non-Qualified Mortgages (Non-QM) exist.

Non-QM loans are built for borrowers who can’t check all the boxes for a government-backed loan. They offer a different kind of flexibility, especially when it comes to proving your income.

Think about a self-employed contractor in Tampa. Their tax returns might not tell the whole story about their cash flow because of business write-offs. A conventional lender's automated system sees those write-offs and often spits out a denial.

With a Non-QM loan from RAC Mortgage, we can look at other documents, like 12 or 24 months of bank statements, to verify income. This common-sense approach paints a much more accurate picture of their ability to afford a mortgage, opening up doors that would have otherwise been slammed shut.

Tailoring the Solution to Your Story

Every homebuyer's journey is different. The right loan for a young family with a steady W-2 income and a few past credit bruises is going to be completely different from the best option for a gig worker with a ton of savings but a spotty paper trail.

Here’s a quick look at how we might approach two different Tampa homebuyers:

-

The First-Time Buyer

- The Challenge: They have a 595 credit score and haven't saved up a huge down payment.

- The RAC Mortgage Solution: An FHA loan is the obvious starting point. The low down payment requirement and more relaxed credit score rules make it a perfect fit, getting them into a home and building equity much sooner.

-

The Business Owner

- The Challenge: They have great income and assets, but proving it the "traditional" way is a nightmare because of how their business is structured.

- The RAC Mortgage Solution: A Non-QM bank statement loan is the way to go. This lets us evaluate their true financial strength and provide a lending solution that actually makes sense for an entrepreneur.

At the end of the day, our goal at RAC Mortgage is to have a real conversation with you. Once we understand your specific circumstances and what you're trying to accomplish, we can zero in on the loan program that not only gets you the keys to a new home but also sets you up for long-term financial success right here in Tampa.

Your Tampa Low Credit Mortgage Questions, Answered

When you’re trying to buy a home with less-than-perfect credit, you're bound to have questions. That’s completely normal. Getting clear, honest answers is the first step, especially when you’re navigating the fast-paced Tampa housing market.

We get these questions all the time at Residential Acceptance Corporation (RAC Mortgage). So, let’s clear the air and demystify the process. A path to owning a home here in Tampa absolutely exists, and we’re here to help you find it.

What Is the Minimum Credit Score for a Tampa Mortgage?

This is easily the most common question we hear. While many big banks and conventional lenders in Tampa might tell you 620 is the magic number, that's not the whole story. As a specialized low credit mortgage lender in Tampa, we know a credit score is just one piece of a much larger puzzle.

Government-backed loans, like an FHA loan, are a great example of this flexibility.

- With a score of 580 or higher, you can often qualify for a down payment as low as 3.5%.

- Even if your score is below 580, the door isn't closed. You might still get approved, but you’ll likely need a larger down payment, usually around 10%.

We look at your complete financial picture—things like a steady income and your savings habits—to find a realistic solution that works for you.

Can I Get a Mortgage After a Bankruptcy or Foreclosure?

Yes, you absolutely can. A major financial event like a bankruptcy or foreclosure feels like a life sentence, but it's not a permanent barrier to owning a home. Traditional lenders might see a red flag, but we see it as a past event you're moving on from.

There are mandatory waiting periods after these events, and each loan program has its own rules. Our job is to help you understand those timelines, map out a recovery plan, and get your application in top shape so you’re ready to go the moment you’re eligible again.

Will My Interest Rate Be Sky-High?

Let's be direct: a lower credit score usually means a higher interest rate. Lenders do this to balance their risk. However, "higher" doesn't have to mean "unaffordable." At RAC Mortgage, we work hard to find the most competitive rate your situation qualifies for.

Securing a mortgage, even with a slightly higher rate, means you start building your own home equity right away instead of paying your landlord's mortgage. Plus, as your credit bounces back, you can often refinance for a lower rate down the road.

This approach gets your foot in the door of homeownership now, with the chance to improve your terms later. If you want to learn more about how we make this happen, check out our guide for Tampa mortgage lenders specializing in bad credit.

Ready to stop wondering and start exploring your real options? The team at Residential Acceptance Corporation is here to walk you through it. Let's talk today and find the right mortgage for your future Tampa home.