When you're buying a home, the sticker price is just the beginning. Lurking behind it are the closing costs, a collection of fees that typically run between 2% to 5% of the home's value. On a $300,000 house, that’s an extra $6,000 to $15,000 in cash you’ll need at the settlement table. For a lot of buyers, that's a serious hurdle.

The big question is, can you avoid paying all that cash upfront? The short answer is yes, you can often roll closing costs into your loan. But it’s not always the right move for everyone.

Your Guide to Rolling Closing Costs Into a Mortgage

This strategy, often called financing your closing costs, adds the fees directly to your total mortgage balance. It’s a popular option for homebuyers who have their down payment saved up but want to keep some cash on hand for the other expenses that inevitably pop up when you buy a new home.

Whether you can and should finance these fees is a critical decision. Your ability to do so depends almost entirely on the specific loan program you choose, as each one plays by its own set of rules. Government-backed loans, for instance, often have more built-in flexibility for this compared to conventional loans.

Understanding Your Options

This is where having a knowledgeable lender in your corner makes all the difference. At Residential Acceptance Corporation (RAC Mortgage), we help borrowers understand every option available so they can make a decision that truly fits their financial goals. Not every loan allows you to finance closing costs, and getting clear on the differences is key.

The main advantage of rolling costs into your loan is simple: you need less cash to close. This makes homeownership more accessible, right now. The trade-off, however, is that you'll pay interest on those fees for the entire life of the loan, which increases your long-term cost.

Before we get into the nitty-gritty, let's take a quick look at which common loan types generally allow you to finance closing costs. The table below gives a high-level overview to help you see where your potential loan might stand and start the conversation with your mortgage advisor.

Loan Program Eligibility for Financing Closing Costs

| Loan Type | Can Closing Costs Be Rolled In? | Key Considerations |

|---|---|---|

| Conventional Loan | Sometimes | Typically requires a higher interest rate in exchange for lender credits that cover costs. |

| FHA Loan | Yes | FHA loans allow sellers to contribute up to 6% of the sale price toward buyer's closing costs. |

| VA Loan | Yes | VA loans permit financing of the VA funding fee, and sellers can pay all other closing costs. |

| USDA Loan | Yes | Allows financing closing costs if the appraised value is higher than the purchase price. |

This table is just a starting point. The specific rules and limitations can get complex, which is why a detailed discussion about your personal situation is so important.

What Are Closing Costs and Why They Matter

Before we can even talk about rolling closing costs into a loan, we need to get a handle on what they actually are. Think of it this way: when you buy a new car, the sticker price isn't the only thing you pay. You've also got taxes, title, and registration fees. Closing costs are the homebuying version of those extra fees.

They're a bundle of separate charges from all the third parties who help make the deal happen—the appraiser, the title company, and others. These costs are completely separate from your down payment but just as critical for finalizing the sale and getting the keys in your hand.

So, how much are we talking about? Closing costs typically run anywhere from 2% to 5% of the home's purchase price. On a $300,000 home, that's an extra $6,000 to $15,000 you need to have ready on closing day. That's a serious chunk of change, which is why figuring out how to manage it is a huge part of the process.

Breaking Down the Fees

While the exact list of fees changes a bit depending on your state and the specifics of your deal, most closing cost statements look pretty similar. These are just the necessary expenses for getting your home loan across the finish line.

You can expect to see things like:

- Loan Origination Fee: This is what your lender, like Residential Acceptance Corporation (RAC Mortgage), charges for putting the loan together—all the paperwork and underwriting.

- Appraisal Fee: A licensed appraiser needs to confirm the home's market value. This reassures the lender (and you) that the property is actually worth the price you're paying.

- Title Insurance: This is a big one. It protects both you and the lender from any old claims or liens against the property that might pop up from previous owners.

- Inspection Fees: You’ll pay for a general home inspection and maybe some specialized ones for things like pests or radon, depending on the property.

- Prepaid Items: Your lender will require you to pay some property taxes and homeowners insurance upfront to fund your escrow account.

Getting familiar with these components is the first step. It helps you understand the real financial weight they carry. Whether you pay them in cash or look into whether closing costs can be rolled into your loan, tackling these expenses is a key piece of the homebuying puzzle. For a closer look at a specific program, check out our guide on FHA loan closing costs.

The choice you make here has a real impact. For instance, on a $400,000 home, closing costs could be between $8,000 and $24,000. If you roll that amount into your mortgage, you avoid a big upfront expense, but your monthly payments will be higher, and you'll pay more in interest over the life of the loan. It's all about trading less cash now for a higher long-term cost.

How Financing Your Closing Costs Actually Works

Okay, so you've figured out you can roll closing costs into your loan. But what does that actually mean for your bottom line? Let's get into the mechanics of it.

The process itself is pretty simple. Your lender takes the total of your eligible closing costs and just adds them right on top of your loan principal. That’s it. The total amount you're borrowing just got a little bigger.

This move is all about managing your cash flow. Instead of writing a massive check for thousands of dollars on closing day, you're spreading that cost out over the life of your mortgage. You're basically trading a lump-sum payment now for a slightly higher mortgage payment later, keeping more cash in your pocket today.

A Practical Example

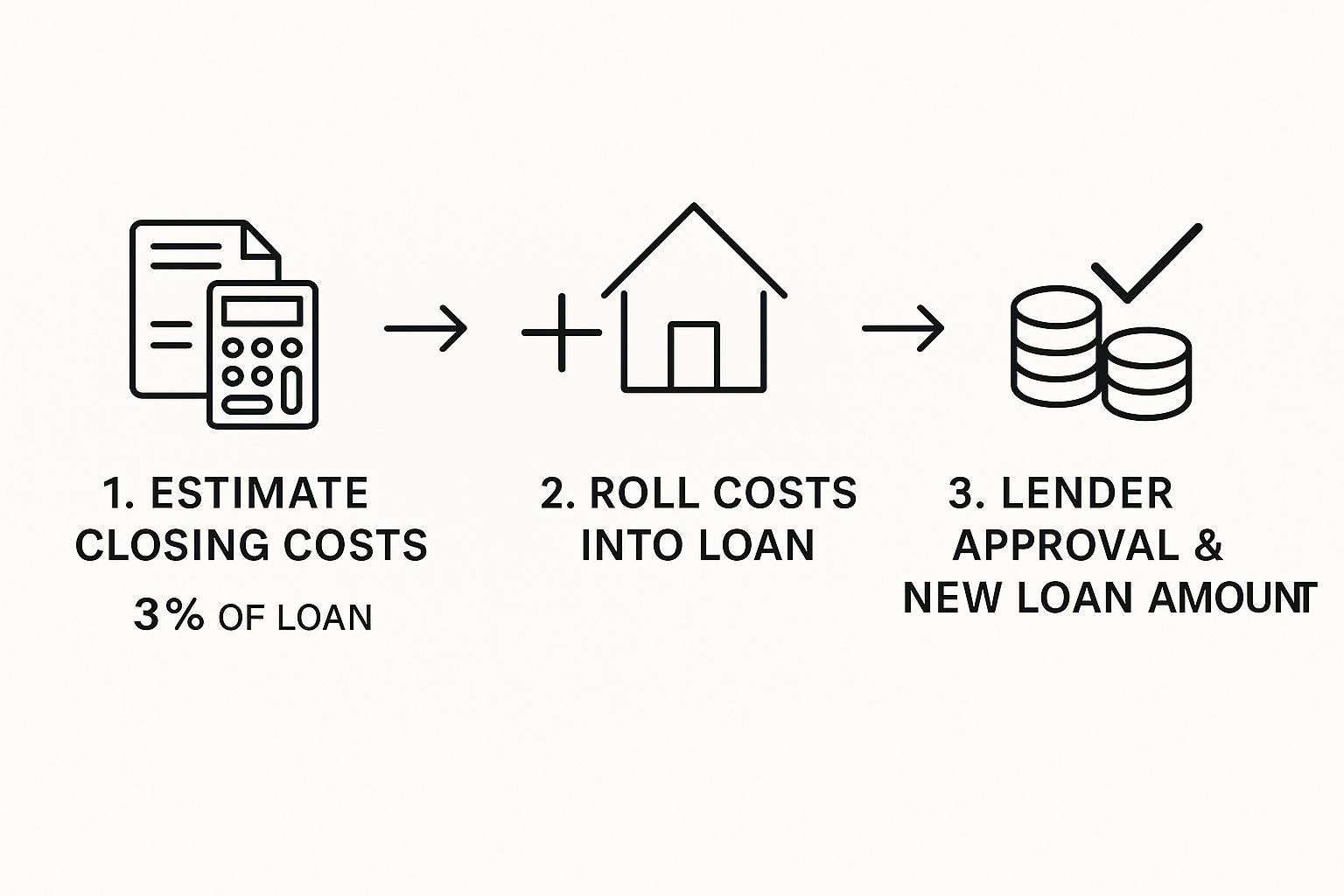

Let's put some real numbers to this. Say you’re buying a $300,000 house and your closing costs come out to $9,000, which is a pretty standard 3%.

- Without Financing: Your loan is for $300,000. You have to show up at the closing table with a separate $9,000 check.

- With Financing: Your new loan amount becomes $309,000. You don't have to bring that extra $9,000 in cash.

This definitely frees up a nice chunk of change for things like moving trucks, new furniture, or just beefing up your emergency fund. But—and this is a big but—you have to look at the long-term picture. That extra $9,000 is now part of your mortgage, and you'll be paying interest on it for the next 15, 20, or 30 years. Your monthly payment will tick up, and the total interest you pay over the loan's lifetime will be higher.

This infographic breaks down how those costs get estimated and folded into your final loan amount.

As you can see, the estimated costs are tacked onto the home's value, creating a new, larger loan principal that the lender then has to approve.

What Can and Cannot Be Included

Here’s a common trip-up: you can't just roll every single closing cost into the loan. Lenders are particular about which fees are fair game. This is exactly where having an expert from a place like Residential Acceptance Corporation (RAC Mortgage) in your corner makes a huge difference.

The key distinction often lies between lender fees and prepaid expenses. While you can frequently finance the costs associated with creating the loan, you typically cannot finance the funds needed to set up your ongoing accounts.

Let's break that down. Generally, here's the deal:

- Eligible for Financing: Think of things that are a direct cost of getting the mortgage itself. Fees for the loan origination, appraisal, credit report, and title insurance can often be rolled in.

- Not Eligible for Financing: Prepaid items are almost always a no-go. This is stuff like your initial payments into an escrow account, which covers your future property taxes and homeowners insurance. You have to pay for those in cash at closing.

Getting this distinction right is crucial for planning your finances. It helps you know exactly how much cash you really need to have on hand, even if you decide financing your closing costs is the way to go.

Loan Programs That Allow You to Finance Closing Costs

Not all mortgages are created equal, and this is especially true when it comes to covering your closing costs. Your ability to roll these fees into the loan itself often comes down to the specific type of mortgage you get. This is where having an expert partner like Residential Acceptance Corporation (RAC Mortgage) really pays off—we help you navigate the fine print.

As a general rule, government-backed loans are your most flexible option. These programs were built from the ground up to make homeownership more accessible, and that includes finding ways to manage the upfront cash needed at closing. Each one, however, plays by its own set of rules.

Getting a handle on these differences is your first step to figuring out which program fits your wallet and whether you can roll closing costs into your loan.

Government-Backed Loan Options

There's a reason these loans are so popular. They often come loaded with features designed to help buyers who might not have a mountain of cash saved up for a down payment and closing costs.

- VA Loans: If you're an eligible veteran, active-duty service member, or surviving spouse, VA loans are a game-changer. The mandatory VA Funding Fee can almost always be rolled right into the loan. On top of that, sellers are allowed to pitch in and cover most of the buyer's other closing costs.

- FHA Loans: A favorite among first-time homebuyers, these loans are insured by the Federal Housing Administration. While you can't just add your closing costs to the principal, the FHA has a clever workaround: sellers can contribute up to 6% of the home's sale price toward your costs. This achieves the same goal of keeping more cash in your pocket.

- USDA Loans: Built for buyers in qualifying rural and suburban areas, USDA loans have a unique perk. If the home appraises for more than what you're paying, you can tap into that extra equity to finance your closing costs. It's an effective way to roll them right into the mortgage.

Conventional Loans and Lender Credits

With conventional loans—the ones not backed by a government agency—directly financing closing costs isn't really a thing. But there's a very common strategy that gets you to the same place: lender credits.

Think of lender credits as a strategic trade-off. Your lender offers to pay for some or all of your closing costs. In return, you agree to a slightly higher interest rate for the life of the loan.

This move can be a lifesaver for borrowers with solid credit who'd rather hold onto their cash. Yes, your monthly payment will be a bit higher, but it knocks down a huge financial hurdle on closing day. For borrowers with more unique financial situations, looking into specialized financing like our Non-QM loan requirements can also open up different ways to structure a deal.

It's clear why these strategies are so important. A surprising 38% of buyers don't even realize they'll have to pay closing costs when they start looking for a home. While many fees can be financed one way or another, it's crucial to know that prepaid items like your first year of homeowners insurance and initial property tax payments usually can't. Understanding that distinction is key. You can discover more insights about these home buying trends on Zillow.com.

Weighing the Pros and Cons of This Strategy

Knowing you can roll closing costs into a loan is one thing, but deciding if you should is a whole different ballgame. It's a handy tool for keeping cash in your pocket when you need it most, but it’s a decision that echoes for the entire life of your loan. A smart choice means looking at both the immediate relief and the future costs with clear eyes.

The whole thing boils down to a simple trade-off: Do you want to hang onto your cash now, even if it means paying more for your house over the next 15 or 30 years? There’s no right or wrong answer—it all depends on your financial picture, your goals, and how comfortable you are with a slightly larger mortgage from day one.

The Upside of Financing Closing Costs

The biggest advantage is pretty obvious: you need less cash to close. This can be an absolute game-changer, especially for first-time buyers who have scraped and saved for a down payment, only to be hit with thousands more in closing costs.

By folding these fees into the mortgage, you keep your savings account from getting wiped out. That financial breathing room is huge when you’re dealing with all the other expenses that pop up with a new home.

This strategy can free up thousands of dollars, providing a crucial financial cushion for moving expenses, essential repairs, new furniture, or simply bolstering your emergency fund for unexpected life events.

Instead of handing over every last dollar just to get the keys, you hold onto your liquidity. That peace of mind alone can be priceless during the chaotic (and expensive) process of settling in.

The Downside of Financing Closing Costs

Of course, that convenience isn't free. The main drawback is that you're adding to your total loan amount. That $9,000 in closing costs on a $300,000 home doesn't just vanish—it gets tacked right on, making your new mortgage $309,000.

This creates a couple of direct problems. First, your monthly mortgage payment will be higher. It might not seem like a lot each month, but it adds up. Second, and more importantly, you will pay more in interest over the life of the loan. You aren't just paying back the closing costs; you're paying interest on the closing costs, potentially for decades.

Pros vs. Cons of Rolling Closing Costs into Your Loan

To help you really see both sides of the coin, here’s a straightforward comparison of the benefits and drawbacks.

| Advantages (Pros) | Disadvantages (Cons) |

|---|---|

| Requires Less Upfront Cash: Makes getting into a home more achievable by slashing the cash needed on closing day. | Increases Loan Principal: Your total mortgage balance is larger from the very beginning. |

| Preserves Your Savings: Keeps your money available for moving, emergencies, repairs, or other investments. | Higher Monthly Payments: A bigger loan means a slightly higher payment every month for the entire term. |

| Greater Financial Flexibility: Gives you a buffer for all the unexpected costs that pop up after buying a home. | More Interest Paid Over Time: You'll pay interest on the closing costs, which increases your total cost of borrowing. |

At the end of the day, the best way to decide is to see the real numbers. The team at Residential Acceptance Corporation (RAC Mortgage) can run a personalized scenario for you, showing you exactly how financing your closing costs will affect your monthly budget and your financial future.

So, Should You Finance Your Closing Costs?

Deciding whether to roll closing costs into your loan isn't a simple yes or no. It's about figuring out what makes sense for your specific financial situation. This isn't just about saving cash today—it's a choice that ripples through your mortgage for years to come.

The right answer really depends on where you're at in life. Let's look at two different homebuyers to see what I mean.

Comparing Homebuyer Scenarios

Imagine a first-time buyer. They have a great, steady job, but they haven't had decades to build up a massive savings account. For them, financing closing costs can be a game-changer. It gets them into a home and starts building equity without wiping out their emergency fund. They'll still have cash for moving expenses, furniture, or those little "surprise" repairs every new homeowner discovers.

Now, think about a different buyer, someone who has a lot of cash saved up. They might see things differently. By paying those closing costs upfront, they keep their total loan amount smaller. That means a lower monthly payment and building equity faster from day one. Their priority is minimizing the total interest they'll pay over the long haul, not holding onto extra cash right now.

At the end of the day, it comes down to one question: What's more important to you right now? Having cash in the bank for flexibility, or locking in a lower total loan cost for the future?

Making the Right Call for the Long Term

The best decision comes from looking at the big picture. You have to see what the real difference in cost is over 15 or 30 years. A slightly higher monthly payment might not seem like a big deal, but it can easily add up to thousands of dollars in extra interest.

And if you're looking at government-backed loans, you need to know their specific rules. You can dig into the details on how to qualify for an FHA loan to see how those guidelines might affect your options.

This is where getting personalized advice is so important. A partner like Residential Acceptance Corporation (RAC Mortgage) can run the numbers based on your exact scenario. We can show you precisely how each choice impacts your monthly budget and your long-term wealth, helping you make a confident decision that you'll feel good about for years.

Your Top Questions About Closing Costs, Answered

The home loan process can feel like a maze of new terms and tricky questions. To help you find your way, we've tackled some of the most common things homebuyers ask when they're wondering, "can closing costs be rolled into a loan?"

Does Financing Closing Costs Affect My Home Equity?

Yes, it absolutely does, right from day one. Think of equity as the part of your home you actually own—the difference between its market value and what you owe the bank. When you finance your closing costs, you're increasing your loan amount before you've even made the first payment.

For example, on a $350,000 home, rolling in $10,000 in closing costs means you start with $10,000 less equity. It's like starting a race a few steps behind the starting line; it just takes a bit longer to build up that valuable ownership stake in your property.

Can I Roll Closing Costs Into a Refinance?

You bet. In fact, it's one of the most common things people do when they refinance. Most homeowners prefer not to pull thousands of dollars out of their savings just to get a new loan on a house they already own.

The mechanics are pretty much the same as with a purchase loan: the lender just tacks the refinance fees onto your new principal balance. The trade-off is identical, too—you're increasing your total debt and the amount of interest you'll pay over the life of the loan.

One key thing to remember when refinancing: lenders have limits. Your new total loan amount, including those rolled-in costs, usually can't go over a certain loan-to-value (LTV) ratio. For many loans, that magic number is around 80% of your home's current appraised value.

Do All Lenders Offer This Option?

This is where things can get tricky—not every lender or loan program plays by the same rules. While government-backed loans like VA and FHA are designed with this flexibility in mind, conventional loans can be a different story. Some lenders simply don't offer it as an option.

That’s why who you work with matters so much. A rigid, one-size-fits-all lender might just say no, but a more flexible and experienced partner will look for a way to say yes. At Residential Acceptance Corporation (RAC Mortgage), our job is to explore every possible angle to find a home loan solution that actually fits your financial goals.

Ready to explore mortgage options with clear, straightforward advice? The experts at Residential Acceptance Corporation are here to guide you through every step of the process.

Find the right home loan for you at racmortgage.com