Thanks to a government guarantee that lowers the risk for lenders, interest rates for usda loan options are some of the most competitive on the market. This opens the door for qualified borrowers in eligible rural and suburban areas to get into a home with affordable financing, often with no down payment required.

What Actually Determines USDA Loan Interest Rates

Getting a handle on what goes into a USDA loan interest rate is the first real step to buying a home with confidence. There's a common myth that the U.S. Department of Agriculture (USDA) just stamps a rate on these loans. The reality is more of a partnership.

The USDA doesn't actually lend the money directly for its Guaranteed Loan Program. What it does is provide a guarantee to private lenders who are the ones issuing the loans. This government backing is like a safety net, which makes it far less risky for lenders to offer really good terms to borrowers.

Because of this guarantee, expert lenders like Residential Acceptance Corporation (RAC Mortgage) can often provide incredible rates to eligible homebuyers. The rate you actually get is set by the lender, and it’s based on a mix of market conditions and your own financial picture.

The True Cost of Borrowing

When you start looking at loan offers, you'll see two main terms pop up: the interest rate and the Annual Percentage Rate (APR). They might sound like the same thing, but they tell you two very different parts of the story. The interest rate is just the cost of borrowing the money. Simple as that.

The APR, on the other hand, gives you the full picture of your loan's total cost.

The Annual Percentage Rate (APR) wraps in the interest rate plus other loan costs and fees, like the USDA guarantee fee and lender origination fees. It shows you the true, all-in cost of your mortgage each year.

Think of it this way: the interest rate is the sticker price on a car. The APR is the "out-the-door" price that includes taxes, title, and all those other dealership fees. Looking at the APR is the only way to accurately compare different loan offers apples-to-apples.

Why Your Lender Matters

Since private lenders are the ones setting the final rates, picking the right one is a huge deal. A lender that specializes in USDA loans just gets it. They know the specific requirements inside and out and understand how to navigate the program's guidelines to find the absolute best financing for you.

When you work with a dedicated lender like RAC Mortgage, you have an expert in your corner guiding you through every step. They’ll dive into your financials, look at the current market, and work to lock in the most favorable interest rates for usda loan products you can get. That knowledge is power, and it’s what turns the dream of owning a home into a reality.

A Snapshot of Current USDA Loan Interest Rates

Getting a handle on the current market is your first step to planning a home purchase, and here’s the good news: interest rates for USDA loan options are often incredibly competitive.

So, why is that? Because the government guarantees these loans, lenders like Residential Acceptance Corporation (RAC Mortgage) can offer much more favorable terms to qualified borrowers. This little perk is what throws the doors to homeownership wide open, especially in designated rural and suburban areas.

These rates don't just appear out of thin air; they dance with the wider economy, moving with the same currents that affect every other mortgage out there. The USDA guarantee, however, acts like a steadying hand, often leading to rates that are right in line with—or even a little better than—conventional loans.

That small advantage can add up to huge savings over the life of your mortgage, making those monthly payments far more manageable. For a lot of families, this is the edge that makes buying a home a reality instead of just a dream.

What Today's Rates Look Like

To really understand the financial landscape, you need to look at real numbers. The market is always in flux, but it's helpful to understand what a typical rate might look like.

For instance, the typical interest rate for a 30-year fixed USDA purchase loan can fluctuate based on market conditions and a borrower's financial profile. The same goes for the annual percentage rate (APR)—which rolls in certain fees and charges.

Similarly, homeowners looking to refinance their existing USDA loan will find that average rates shift with the market. Keep in mind, these numbers assume a strong credit score, which is key to locking in the best possible terms.

These figures really drive home the affordability built into the USDA program. A lower rate, even by a fraction of a percent, can shrink your monthly payment and save you thousands of dollars over the years.

To get the most accurate and up-to-date rate information, it is always best to speak directly with a loan specialist.

Typical USDA Loan Interest Rates Snapshot

This table gives you a quick look at the types of loans available. Think of these as a starting point—the rate you actually get will depend on your personal financial situation.

| Loan Type | Term |

|---|---|

| Fixed Purchase | 30-Year |

| Fixed Refinance | 30-Year |

This snapshot is your launchpad. It provides a realistic benchmark as you start talking with a specialized lender like RAC Mortgage. They can walk you through how your individual circumstances—like your credit score and debt-to-income ratio—will shape the final rate you're offered. Having this data in your back pocket empowers you to ask the right questions and move forward with confidence.

The Personal Factors That Shape Your Rate Offer

The advertised interest rates for USDA loans you see online are really just a starting point. The final rate you get offered is a deeply personal number, tailored specifically to your unique financial picture. Lenders look at several key pieces of your story to figure out the level of risk in lending to you, and that risk is what sets your interest rate.

Think of it like getting car insurance. A driver with a spotless record gets a much better premium than someone with a history of fender benders. In the mortgage world, lenders like Residential Acceptance Corporation (RAC Mortgage) do the same thing by reviewing your financial history. Knowing what they’re looking for puts you in the driver’s seat.

Your Credit Score: The Financial Report Card

Your credit score is probably the single most important factor. It’s one number that neatly summarizes your entire history of managing debt, acting as a quick financial report card for any lender. A high score sends a clear message: you have a proven track record of paying your bills on time.

That history of reliability makes you look like a safer bet to the lender, which usually translates into a better interest rate. While the USDA program is known for being flexible, most lenders want to see a score of 640 or higher. If you really want to lock in the most competitive rates, aiming for a score around 740 is a fantastic goal.

A strong credit score is more than just a number; it’s a powerful negotiating tool. Even a small bump in your score can potentially unlock a lower interest rate, saving you thousands over the life of your loan.

Debt-to-Income Ratio: Managing Your Monthly Budget

Next up, lenders will zoom in on your debt-to-income (DTI) ratio. This number simply compares your total monthly debt payments (think car loans, student loans, credit card bills) to your gross monthly income. It’s how lenders get a quick snapshot of your ability to comfortably take on a new mortgage payment.

The USDA generally likes to see a DTI ratio that doesn’t go above certain limits, typically around 41%. This tells them that your total monthly debts, including your new house payment, won't eat up more than 41% of your income. A lower DTI shows you've got plenty of breathing room in your budget, making you a much less risky borrower. It’s also good to remember that your income itself has to fall within certain guidelines; you can learn more about USDA loan income limits in our detailed guide.

Loan Term and Economic Forces

A couple of other big pieces play a role in shaping your final USDA loan rate. Some of these are your personal choices, while others are bigger economic forces completely out of your control.

- Loan Term: You’ll usually have a choice between a 15-year and a 30-year loan. The 15-year option almost always has a lower interest rate, but the monthly payment will be higher. A 30-year loan spreads the cost out, giving you a lower monthly payment but a slightly higher interest rate in return.

- Federal Reserve Policies: Any time the Federal Reserve makes a move, it sends ripples across the entire economy. When the Fed adjusts its key rates to fight inflation or boost the economy, those changes trickle down and affect mortgage rates.

- Market Conditions: The general health of the economy and the bond market have a big say, too. Lenders are constantly adjusting their rates based on these broader economic trends.

By focusing on the things you can control—like polishing your credit and keeping your debt in check—you put yourself in the best possible position to get a great rate, no matter what the market is doing. Working with a specialist like RAC Mortgage means you'll have an expert guiding you through every one of these factors to build the strongest application possible.

How USDA Loan Rates Stack Up Against the Competition

To really appreciate the power of a USDA loan, you have to see how it performs against the other big players in the mortgage world. Putting interest rates for usda loan options side-by-side with conventional and FHA loans shows exactly why this program is such a game-changer for homebuyers in the right areas.

The secret sauce is the USDA's government guarantee. This guarantee dramatically lowers the risk for lenders like Residential Acceptance Corporation (RAC Mortgage). What does that mean for you? It means we can often offer more competitive interest rates and better terms, especially if you haven't saved up a huge down payment. It’s a true win-win that makes owning a home a reality for more people.

A Head-to-Head Comparison

While the interest rate gets most of the attention, it’s only one part of the story. The true cost of any loan also includes things like your down payment and monthly mortgage insurance. When you look at the whole picture, the value of a USDA loan really starts to shine.

- USDA Loans: These are famous for one huge feature: the $0 down payment. Yes, you read that right. While they do have an upfront guarantee fee and a small annual fee, these are often far more affordable than the mortgage insurance required by other loan types.

- FHA Loans: Backed by the Federal Housing Administration, these are a go-to for many first-time buyers. They require a minimum down payment of 3.5% and come with a mandatory Mortgage Insurance Premium (MIP), which in most cases, you'll pay for the entire life of the loan.

- Conventional Loans: These are the traditional loans you hear about that aren't government-backed. They usually require a stronger credit score. And while some programs let you get in the door with as little as 3% down, you'll almost always have to pay for Private Mortgage Insurance (PMI) until you've built up 20% equity in your home.

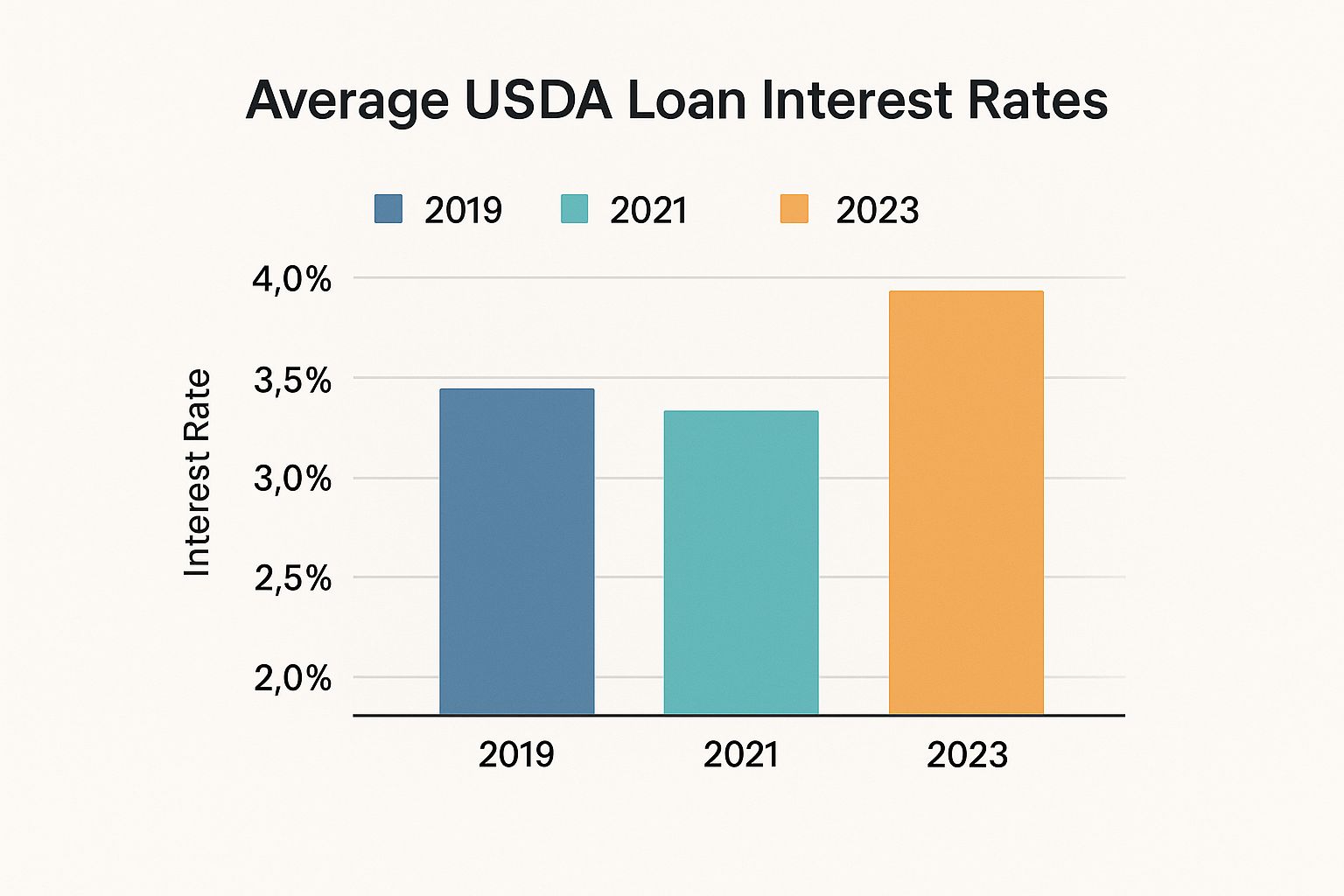

This chart gives you a quick look at how average USDA loan interest rates have performed over the years, proving just how affordable this program consistently is.

As you can see, USDA rates have a history of staying low even when the market gets bumpy, highlighting the program's stability.

To give you an even clearer snapshot, here’s a simple table comparing the major loan options.

USDA vs Other Major Loan Types A Comparison

| Feature | USDA Loan | FHA Loan | Conventional Loan |

|---|---|---|---|

| Minimum Down Payment | 0% | 3.5% | 3% – 20%+ |

| Mortgage Insurance | Upfront & Annual Guarantee Fee | Upfront & Annual MIP | PMI required with <20% down |

| Location Requirement | Must be in an eligible rural or suburban area | None | None |

| Credit Score | Generally 640+ | More flexible, often 580+ | Typically 620+ for best rates |

The comparison makes it pretty clear: for borrowers who meet the criteria and are buying in an eligible area, the USDA loan's mix of zero down payment and competitive rates is tough to beat. It effectively removes two of the biggest financial hurdles that stop people from buying a home.

When you understand where the USDA loan fits into the broader market, you can see its true value. For those who qualify, it’s more than just another mortgage—it’s a specialized tool designed to open the door to homeownership. By exploring the full range of USDA loan products, you can find out if this powerful option is the right move for you.

A Historical View of USDA Interest Rate Cycles

Today's USDA loan interest rates are really just a single frame in a much longer movie. To get a feel for what today's rates actually mean, it helps to pull back and see the entire story. Mortgage rates aren't set in stone; they move up and down in cycles, pushed and pulled by the economy, inflation, and big-picture financial policies.

This isn't just a history lesson for the sake of it. It's about getting some much-needed perspective. When you see how much rates have bounced around over the years, it can take a lot of the stress out of trying to perfectly "time" your home purchase. The simple truth is, rates have been much, much higher—and yes, a bit lower—than what we're seeing right now.

The Highs and Lows of Past Decades

The story of USDA loan rates is really a story about our economy's own ups and downs. A lot of homebuyers today would probably be shocked to see the kind of rates people dealt with in the past.

Just look at the numbers. During the crazy inflation of the late 1970s and early 1980s, rates were through the roof. On March 11, 1978, a Rural Housing loan came with an 8.75% interest rate. That sounds high, but by October 1, 1981, it had blasted up to an unbelievable 17.5%. You can actually see the full timeline of these rate changes in the official USDA records.

Now, compare that to the record-low rates we saw just a few years ago when the economic picture was completely different. These extreme peaks and valleys show that the market has a natural rhythm.

Looking at today's rates with a bit of history in mind shows us that ups and downs are normal. More importantly, it proves the USDA program has been a steady source of affordable home financing for decades, no matter what the economy was doing.

What History Teaches Us About Today's Rates

Knowing this history gives you power. It makes it clear that while you can't control the market, you can understand how it behaves. Instead of losing sleep trying to snag the absolute lowest rate in history, you can zero in on finding a rate that fits your budget today.

The whole point of the USDA loan program has always been to open the door to homeownership for people in rural and suburban areas. Through thick and thin, it’s always been there as a stable and affordable option.

When you work with a lender who gets this bigger picture, like Residential Acceptance Corporation (RAC Mortgage), you can move forward with confidence. They can help you lock in a great rate that makes sense for your family, regardless of where we happen to be in the current interest rate cycle.

Proven Strategies to Lock In Your Best Rate

Knowing what influences your USDA loan rate is one thing, but putting that knowledge into action is what saves you money. It’s time to get proactive. Landing the best possible interest rates for usda loan products isn't about luck; it's about making smart moves that position you as a strong, reliable borrower.

Think of this as your roadmap to a more affordable home. Each of these steps puts you in the driver's seat, giving you a direct say in the rate you're offered.

Fortify Your Financial Profile

The most important work you can do happens long before you start scrolling through home listings. Your financial health is the bedrock of your loan application, and making it stronger can lead to huge savings over the life of your loan.

Your credit score is like your financial report card. The single best way to improve it is by consistently paying all your bills on time, every time. That includes credit cards, car loans, and student loans. Even a small bump in your score can make a lender like Residential Acceptance Corporation (RAC Mortgage) view your application much more favorably.

At the same time, get your debt-to-income (DTI) ratio as low as possible. This is just a fancy way of comparing what you owe each month to what you earn. You can lower it by paying down high-interest credit card debt or simply by holding off on any new big purchases until after you close on your home.

The Power of a USDA Loan Specialist

You don't have to navigate the mortgage maze by yourself. In fact, working with a lender who truly specializes in USDA loans is a major advantage. These are the experts who live and breathe the specific rules and quirks of the USDA program day in and day out.

A specialist at RAC Mortgage gets the nuances that a general lender might overlook. They know how to package your application to play up your strengths and can steer you around common bumps in the road that might otherwise slow you down or lead to a higher rate.

Partnering with an expert isn't just about getting a loan; it's about securing the right loan with the best possible terms. Their deep knowledge of the USDA program can be the key to unlocking a more favorable interest rate.

Getting pre-approved is a critical first move. You can learn more about how to get preapproved and start the process with confidence by reviewing our guide. A pre-approval doesn't just show sellers you're serious; it gives you a concrete budget to work with.

Lock In Your Rate to Beat Market Volatility

Once you've found your dream home and the loan process is underway, the market can still throw you a curveball. Mortgage rates can change daily. To shield yourself from a last-minute rate hike, you need a rate lock.

A rate lock is a simple agreement with your lender to freeze your interest rate for a set amount of time, usually 30 to 60 days, while your loan is finalized. It’s your safety net. This one move provides incredible peace of mind, guaranteeing that the rate you were quoted is the one you'll have at the closing table, no matter what the market decides to do.

Common Questions About USDA Loan Interest Rates

As you get closer to buying your home, a few last-minute questions always seem to pop up. It's totally normal. We'll clear up some of the most common uncertainties about USDA loan interest rates right here, giving you straight answers so you feel completely prepared.

Think of this as your final check-in to lock down what you've learned and build your confidence before taking that exciting next step.

Can My USDA Loan Interest Rate Change Over Time?

This is a huge question, and the answer offers some serious peace of mind. The vast majority of USDA loans are structured as 30-year fixed-rate mortgages.

"Fixed-rate" is the magic phrase here. It means your interest rate is locked in for the entire life of the loan—it will never change. This gives you a stable, predictable principal and interest payment every month, shielding you from any future spikes in the market. That predictability is one of the program's biggest draws.

What Credit Score Do I Need for the Best Rate?

While the USDA program is famous for its flexibility, lenders still need to see a solid credit history before they'll offer their most competitive rates. In most cases, a credit score of 640 or higher is the baseline to get your foot in the door with most lenders.

But if you're aiming for the very best rates out there, shooting for a score of 720 or higher is a smart move. A higher score signals to lenders like Residential Acceptance Corporation (RAC Mortgage) that you're a lower-risk borrower, and they'll often reward that with a better rate.

Your credit score is one of the most powerful tools you have in this process. Even a small bump in your score can unlock a lower rate, potentially saving you tens of thousands of dollars over the 30-year life of your loan.

Is the USDA Annual Fee the Same as My Interest Rate?

It's really easy to get these two mixed up, but they are completely different costs. Here's the breakdown:

- Interest Rate: This is what the lender charges you for borrowing the money. It's the core component that determines your monthly mortgage payment.

- Annual Guarantee Fee: Think of this as the program's insurance policy. It's a small fee (currently 0.35% of your outstanding loan balance each year) that's paid to the USDA. This fee protects the lender and helps keep the whole USDA loan program funded and available. It's simply broken down into 12 parts and added to your monthly payment.

So, while both are part of your total monthly housing payment, they serve two very different functions. The annual fee is a program requirement, while your interest rate is the direct cost of borrowing from your specific lender.

Ready to see what USDA loan options are waiting for you? The expert team at Residential Acceptance Corporation (RAC Mortgage) is here to walk you through every step and help you lock in the best possible rate. Find out if you qualify today at https://racmortgage.com.