FHA loans are often celebrated as the go-to solution for homebuyers with lower credit scores or limited savings, thanks to their accessible down payment and flexible underwriting criteria. This reputation makes them a popular first choice, particularly for first-time buyers eager to enter the market. However, this accessibility comes with significant trade-offs that are frequently overlooked in the initial excitement of the home search. These potential drawbacks, from persistent insurance costs to strict property standards, can have long-term financial implications.

Understanding the full picture is crucial before committing to a mortgage that will shape your finances for decades. This article dives deep into the primary disadvantages of an FHA mortgage, moving beyond the well-known benefits to reveal the hidden costs and limitations. We will explore the seven most critical drawbacks you need to consider, providing the clarity necessary to determine if an FHA loan truly aligns with your financial strategy. At Residential Acceptance Corporation (RAC Mortgage), our goal is to equip you with comprehensive insights, ensuring you can confidently choose the right financing path. By examining these challenges head-on, you can avoid common pitfalls and secure a home loan that supports your long-term success.

1. Mortgage Insurance Premium (MIP) Requirements

One of the most significant and costly disadvantages of an FHA mortgage is the mandatory Mortgage Insurance Premium (MIP). This insurance protects the lender, not the borrower, in case of default. Unlike private mortgage insurance (PMI) on conventional loans, FHA MIP has stricter, more expensive, and longer-lasting requirements that substantially increase the total cost of homeownership.

How FHA MIP Works

FHA loans require two forms of mortgage insurance:

- Upfront Mortgage Insurance Premium (UFMIP): This is a one-time fee, currently 1.75% of the total loan amount. While you can pay it in cash at closing, most borrowers choose to roll it into their mortgage balance. This increases the total amount you owe and the interest paid over the life of the loan.

- Annual Mortgage Insurance Premium: This is an ongoing monthly payment. The annual premium ranges from 0.45% to 1.05% of the loan balance and is divided by 12 to determine your monthly payment. The exact rate depends on your loan term, loan amount, and initial loan-to-value (LTV) ratio.

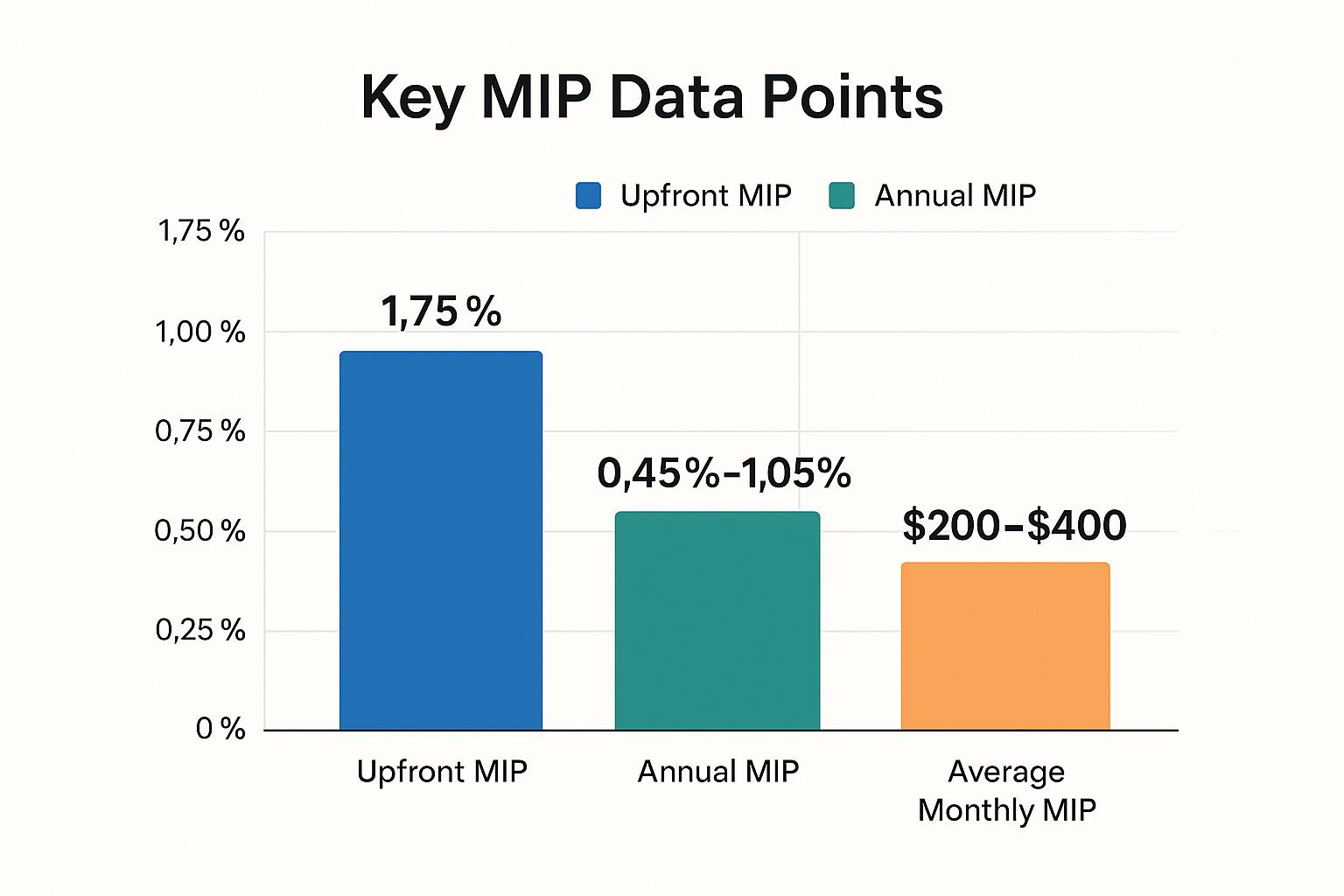

For a clearer picture, the following bar chart visualizes the key figures associated with FHA MIP costs.

The chart highlights how both the significant upfront cost and the persistent monthly payments contribute to the overall expense of an FHA loan.

The Long-Term Cost

The most critical drawback is the duration of MIP payments. If you make a down payment of less than 10%, you are required to pay the annual MIP for the entire loan term, typically 30 years. It does not automatically cancel once you reach 20% equity, as PMI on conventional loans often does.

Real-World Example: On a $300,000 FHA loan with a 3.5% down payment, your UFMIP would be approximately $5,153, added to your loan. Assuming an annual MIP rate of 0.85%, your monthly MIP payment would be around $207. Over 30 years, you would pay over $74,500 in monthly MIP alone, plus the upfront premium.

The only way to eliminate FHA MIP is to refinance into a different loan type, such as a conventional mortgage, once you've built sufficient equity. If you are exploring ways to reduce these ongoing costs, you can find strategies for how to lower your mortgage payment through refinancing and other methods.

2. Loan Limits and Geographic Restrictions

Another significant drawback of FHA financing is its strict loan limits, which cap the maximum amount you can borrow. These limits are determined by the Federal Housing Administration and vary significantly by county, often falling short of the amounts needed in high-cost-of-living areas. This disadvantage can severely restrict your housing options or even disqualify you from purchasing a home in your desired market.

How FHA Loan Limits Work

The FHA sets a national "floor" and "ceiling" for its loan limits each year based on median home prices. Individual county limits are then calculated as a percentage of the area's median home price, fitting between this floor and ceiling.

- Low-Cost Areas: In most parts of the country, the 2024 standard limit for a single-family home is $498,257.

- High-Cost Areas: In expensive metropolitan markets like parts of California, New York, and Hawaii, the limit can go as high as the national ceiling of $1,149,825.

These restrictions mean that if the home you want to buy costs more than the FHA limit for that specific county, you cannot use an FHA loan to finance it, regardless of your income or credit score. This can be a major hurdle in competitive real estate markets where prices are consistently high.

The Real-World Impact

The geographic restrictions create a clear disadvantage for buyers in many urban and suburban centers. A home that would be well within FHA limits in one county could be completely out of reach just a few miles away in a neighboring, more expensive county.

Real-World Example: In the San Francisco Bay Area, many entry-level single-family homes are priced well above the FHA's maximum loan limit, forcing potential buyers to seek conventional financing or look in less desirable locations. Similarly, in Seattle's popular suburbs, median home prices frequently surpass what an FHA loan will cover.

Before you begin your home search, it is crucial to verify the specific limits in your target area. To understand the full scope of eligibility requirements, you can learn more about how to qualify for an FHA loan and see if it aligns with your financial situation and homeownership goals.

3. Strict Property Condition Requirements

Another significant disadvantage of an FHA mortgage is the stringent property condition standards mandated by the Department of Housing and Urban Development (HUD). To be approved for an FHA loan, a home must pass a specific FHA appraisal that evaluates its safety, security, and soundness. While intended to protect buyers, these strict requirements can limit property choices, create unexpected expenses, and even cause a purchase to fall through, especially with older or fixer-upper homes.

These requirements go beyond a standard home appraisal, which primarily assesses value. An FHA appraiser must ensure the property meets HUD's "Minimum Property Standards," looking for issues that could impact the occupants' health and safety.

Common FHA Appraisal Hurdles

An FHA appraiser will "red flag" any defects that fail to meet these minimum standards. The loan will not be approved until these issues are repaired, often at the seller's expense. Common problems include:

- Safety Hazards: Exposed wiring, non-functional HVAC systems, or missing handrails on stairs.

- Structural Issues: Significant foundation cracks, evidence of termite damage, or a leaking roof.

- Paint and Surfaces: Peeling or chipping paint in homes built before 1978 due to lead-based paint risks.

- Utilities and Access: The property must have adequate and safe utility connections and be accessible year-round.

These hurdles can be a major roadblock, particularly in competitive markets where sellers may prefer offers with fewer contingencies, such as those from conventional loan buyers.

Navigating the Requirements

The inflexibility of these standards is a key reason this is one of the disadvantages of an FHA mortgage. A buyer can't simply agree to fix the issues after closing; the repairs must be completed and re-inspected before the loan is funded.

Real-World Example: A buyer finds an otherwise perfect home, but the FHA appraisal notes significant peeling exterior paint. The seller receives a repair estimate of over $3,000. If the seller refuses to pay for the repairs, and the buyer cannot afford them out-of-pocket before closing, the transaction is likely to be canceled.

To avoid this scenario, it is crucial to work with professionals who understand FHA guidelines. The experienced loan officers at Residential Acceptance Corporation can provide guidance on potential property issues early in the process, helping you prepare for the FHA appraisal and navigate any required repairs smoothly.

4. Extended Processing Times and Paperwork

Another significant disadvantage of an FHA mortgage is the potential for longer processing times and more extensive paperwork compared to conventional loans. The government-backed nature of these loans introduces additional layers of bureaucracy and stricter documentation requirements, which can delay the closing process and create stress for buyers, especially in fast-moving real estate markets.

How FHA Processing Works

FHA loans are insured by the Federal Housing Administration, which means lenders must adhere to rigorous government guidelines to ensure the loan qualifies for this insurance. This process often includes:

- Extensive Documentation: Lenders must verify every aspect of your financial life, including income, employment history, credit, and the source of your down payment. This often requires more paperwork than a conventional loan.

- Multiple Approval Layers: The loan file goes through multiple checks, both internally with the lender and to ensure it meets all FHA standards. This multi-layered approach can add significant time to the underwriting process.

- Strict Appraisal Requirements: FHA appraisals have specific health and safety standards the property must meet. If the appraiser finds issues, they must be repaired before the loan can close, causing further delays.

These additional steps mean an FHA loan typically takes 45 to 60 days to close, whereas a conventional loan might close in 30 to 45 days. This delay can be a major drawback in a competitive bidding situation.

The Real-World Impact

The extended timeline is not just an inconvenience; it can have tangible negative consequences for homebuyers. The slower pace can put FHA borrowers at a disadvantage against those with conventional financing or cash offers who can promise a quicker closing.

Real-World Example: Imagine you are in a competitive market and find your dream home. You make an offer with FHA financing, but another buyer offers the same price with a conventional loan that can close in 30 days. The seller, eager to move quickly, accepts the other offer, and you lose the house solely due to your loan's longer timeline.

To navigate this, it's crucial to be prepared. Proactively gathering the documents needed for a mortgage can help speed up the process on your end. Working with an experienced FHA lender like Residential Acceptance Corporation, who understands the nuances of the system, can also help streamline the application and avoid unnecessary delays.

5. Competitive Disadvantage in Multiple Offer Situations

In a competitive real estate market, one of the most frustrating disadvantages of an FHA mortgage is that it can put you at a significant disadvantage against other buyers. Sellers often prefer conventional or cash offers due to perceived risks and complexities associated with FHA financing. This preference can lead to your well-crafted offer being overlooked, even if it meets the seller's asking price.

Why Sellers May Hesitate

Sellers and their agents may be wary of FHA offers for several key reasons, which can make your bid less attractive in a multiple-offer scenario:

- Strict Appraisal and Inspection Standards: FHA loans have minimum property standards that are stricter than most conventional loans. Appraisers must ensure the home is safe, sound, and secure, which could mean flagging peeling paint, old roofs, or faulty handrails. Sellers may fear that these requirements will lead to mandatory, costly repairs or cause the deal to fall through.

- Perception of Longer Closing Times: While not always true, there is a common perception that FHA loans take longer to close due to more rigorous government-backed underwriting and appraisal processes. In a hot market, sellers prioritize speed and certainty.

- Concerns About Buyer Financials: Because FHA loans are designed for borrowers with lower down payments and credit scores, some sellers assume FHA buyers are less financially stable. This can create a bias, making them favor offers from buyers with conventional financing who may have a larger down payment.

These factors combine to create a challenging environment for FHA-backed buyers, especially when multiple bids are on the table.

The Real-World Impact

The bias against FHA loans is not just theoretical; it actively prevents buyers from securing their desired home. It is not uncommon for a seller to accept a slightly lower conventional offer over a full-price FHA offer simply to avoid potential financing hurdles. Some property listings will even explicitly state "No FHA" or "Conventional or Cash Only," shutting out FHA buyers from the start.

Real-World Example: Imagine you submit an offer for $350,000 (the full asking price) on a home using your FHA pre-approval. Another buyer offers $345,000 with a conventional loan and a 20% down payment. The seller, worried about potential FHA appraisal repairs and a longer closing, accepts the lower conventional offer for a quicker, more certain sale.

To overcome this, it's crucial to work with a mortgage provider like Residential Acceptance Corporation (RAC Mortgage) who can ensure your pre-approval is solid and your agent can effectively communicate the strength of your offer to the seller. Making your offer stronger with a larger earnest money deposit or a personal letter to the seller can also help level the playing field.

6. Occupancy Requirements and Investment Restrictions

A significant drawback of FHA mortgages that impacts flexibility is the strict owner-occupancy requirement. FHA loans are designed to promote homeownership, not real estate investment, and the rules reflect this purpose. This mandate can create significant hurdles for borrowers whose life circumstances change or those who have investment aspirations.

How FHA Occupancy Rules Work

The FHA requires that at least one borrower occupy the property as their primary residence within 60 days of closing and live there for at least one full year. This rule directly limits how you can use the property and makes FHA loans unsuitable for certain goals.

- Primary Residence Only: You cannot use an FHA loan to purchase a second home, a vacation getaway, or a property intended solely for rental income. The home must be your main place of living.

- One-Year Commitment: You are contractually obligated to live in the home for a minimum of 12 months. Moving out early without a valid, FHA-approved reason could be considered mortgage fraud.

These restrictions are a key reason why FHA loans lack the versatility of conventional mortgages, which often allow for the purchase of investment properties or second homes with different down payment and qualification requirements.

The Real-World Complications

This one-year rule can become a major issue when unexpected life events occur. It reduces your ability to adapt to new opportunities or handle personal emergencies without potential complications with your lender.

Real-World Example: Imagine you secure an FHA loan and move into your new home. Six months later, you receive an unexpected but life-changing job offer in another state. Because you haven't fulfilled the 12-month occupancy requirement, you cannot simply rent out the property. You would need to seek permission from your lender or potentially sell the home, which can be financially difficult so soon after a purchase.

Other situations, like a military deployment or a family emergency requiring you to relocate, also create conflicts with this rule, although some exceptions may apply. These scenarios highlight one of the major disadvantages of an FHA mortgage: a lack of flexibility for life's unpredictability. If you anticipate any major life changes, discussing your options for different loan types with a mortgage expert is essential.

7. Potential for Negative Equity and Refinancing Challenges

A significant risk associated with FHA loans is the heightened potential for negative equity, also known as being "underwater" on a mortgage. This occurs when the outstanding loan balance exceeds the home's market value. The low down payment requirement, combined with upfront costs like MIP being rolled into the loan, can create a precarious financial situation, especially if property values decline.

How Negative Equity Occurs

The core appeal of an FHA loan is its minimal down payment, often just 3.5%. However, this means you start with very little equity. This small equity cushion can be quickly erased by several factors:

- Market Fluctuations: Even a minor downturn in the local housing market can leave a recent FHA borrower owing more than their home is worth.

- Upfront Costs: Rolling the 1.75% Upfront Mortgage Insurance Premium (UFMIP) into the loan immediately increases your debt, putting you further from a positive equity position from day one.

- Slow Equity Buildup: In the early years of a mortgage, most of your payment goes toward interest, not principal. This slow pace of equity accumulation makes you more vulnerable to market shifts.

This situation traps homeowners, making it nearly impossible to sell without bringing cash to closing or to refinance into a more favorable loan.

The Refinancing Trap

Negative equity presents a major barrier to refinancing. Most lenders, including those offering conventional loans, will not approve a refinance application if the loan-to-value (LTV) ratio is over 100%. This can trap you in your FHA loan, even if interest rates drop significantly, forcing you to continue paying high MIP for years.

Real-World Example: Imagine you buy a home for $350,000 with a 3.5% down payment. Your initial loan is $337,750, but after adding the UFMIP ($5,910), your total balance becomes $343,660. If a local market correction causes your home's value to drop by just 5% to $332,500, you are now underwater by over $11,000 and unable to refinance into a conventional loan to eliminate MIP.

While the FHA Streamline Refinance program can sometimes offer a path for underwater borrowers, it doesn't eliminate the underlying problem of negative equity. To avoid this pitfall, it's wise to make a larger down payment if possible and thoroughly research local market trends before committing to a purchase.

Disadvantages Comparison of 7 FHA Mortgage Factors

| Item | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Mortgage Insurance Premium (MIP) Requirements | Moderate – ongoing payments and refinancing needed | High – upfront and monthly premiums increase costs | Increased long-term loan cost, consistent monthly expense | Borrowers with less than 20% down payment needing low initial cash | Enables low down payment loans with government backing |

| Loan Limits and Geographic Restrictions | Low – limits vary by location, easy to verify | Low – no extra resources, but may limit options | Restricted property choices, may require conventional loan for expensive homes | Buyers in low to moderate cost areas or seeking affordable homes | Protects against over-borrowing in high-cost areas |

| Strict Property Condition Requirements | High – mandatory FHA appraisal and repair negotiation | High – potential costly repairs and delays | Possible transaction delays, additional repair costs | Buyers flexible on property condition or willing to invest in repairs | Ensures property safety and habitability standards |

| Extended Processing Times and Paperwork | High – multiple reviews and documentation steps | High – detailed paperwork and approvals required | Longer closing times, higher stress and risk of delays | Buyers with flexible timelines and ability to prepare documents early | Government oversight reduces default risk |

| Competitive Disadvantage in Multiple Offer Situations | High – FHA offers less attractive to sellers | Moderate – may require concessions or backup financing | Lower acceptance rates, need for higher offers or longer search | Buyers in seller’s markets or with less competitive offers | Access to homeownership despite market challenges |

| Occupancy Requirements and Investment Restrictions | Low to Moderate – strict rules but straightforward | Low – mostly compliance and monitoring | Limited flexibility, must occupy home as primary residence | Owner-occupants committing to living in property at least one year | Prevents misuse of FHA loans for investment or vacation homes |

| Potential for Negative Equity and Refinancing Challenges | Moderate – influenced by market and loan terms | Moderate – risk of underwater loans and refinancing limits | Risk of negative equity, refinancing difficulties | Buyers aware of market risks and prepared with contingency plans | Lower down payment options facilitate entry into homeownership |

Making the Right Mortgage Choice for Your Future

Choosing a mortgage is one of the most significant financial decisions you'll ever make, and understanding the nuances of different loan types is crucial for long-term success. While FHA loans offer an accessible path to homeownership with their lenient credit requirements and low down payment options, they are not a one-size-fits-all solution. As we've explored, the disadvantages of an FHA mortgage can have a substantial impact on your finances, from the persistent cost of Mortgage Insurance Premiums (MIP) to the competitive challenges you might face in a hot real estate market.

The key takeaway is that the "best" mortgage is entirely dependent on your individual circumstances. A loan that works perfectly for one buyer might be a costly mistake for another. It's essential to perform a careful cost-benefit analysis, weighing the immediate advantage of a lower down payment against the long-term expenses and limitations of an FHA loan.

A Strategic Recap of FHA Loan Drawbacks

Let's quickly revisit the critical disadvantages we've covered:

- Persistent Mortgage Insurance: Unlike conventional loans where PMI can be removed, FHA MIP often lasts for the life of the loan, adding thousands of dollars in extra costs.

- Property and Loan Limitations: FHA loan limits can restrict your buying power in high-cost areas, and their strict property condition standards can disqualify fixer-upper homes.

- Competitive Hurdles: In a seller's market, an offer backed by an FHA loan can sometimes be viewed as less competitive than one with conventional financing, potentially putting you at a disadvantage.

Your Actionable Next Steps

Mastering these concepts empowers you to move beyond a simple pre-approval and make a truly informed decision. Before committing to an FHA loan, take these proactive steps:

- Calculate Your Total Cost: Use an online mortgage calculator to compare the total lifetime cost of an FHA loan (including MIP) versus a conventional loan, even if the latter requires a slightly higher down payment.

- Assess Your Market: Speak with your real estate agent about how FHA offers are currently being received in your target neighborhoods. This insight can help you set realistic expectations.

- Seek Expert Guidance: A qualified mortgage professional can analyze your complete financial picture, including credit score, debt-to-income ratio, and savings, to model different loan scenarios. This personalized analysis is invaluable.

Ultimately, the goal is not to dismiss FHA loans entirely but to approach them with a clear understanding of their potential downsides. By carefully weighing the disadvantages of an FHA mortgage against its benefits, you position yourself to select a financing option that aligns perfectly with your financial goals, ensuring your new home is a source of security and prosperity for years to come.

Navigating the complexities of FHA, conventional, and other loan options can be challenging. The expert loan originators at Residential Acceptance Corporation specialize in helping homebuyers analyze the pros and cons to find the ideal mortgage for their unique situation. Contact us today at Residential Acceptance Corporation to get a clear, personalized roadmap for your homeownership journey.