Applying for a home loan can feel like navigating a complex maze of paperwork. Understanding what documents are needed for a mortgage is the single most important step to ensure a smooth and fast closing. A complete and organized document package not only speeds up the process but also demonstrates your financial readiness to Residential Acceptance Corporation (RAC Mortgage). A prepared borrower is key to their success in closing loans in as little as 18 to 20 days.

This comprehensive roundup serves as your definitive checklist, removing the guesswork from the application process. We will break down every essential document category required for underwriting, including:

- Proof of Income (Pay Stubs and W-2s)

- Tax Returns (Form 1040)

- Bank Statements

- Employment Verification

- Credit History Documentation

- Asset Statements

- The Purchase Agreement

- Debt and Obligation Records

By gathering these items in advance, you position yourself for a seamless journey from application to homeownership. This guide provides the specific, actionable details you need to confidently partner with the expert team at RAC Mortgage and secure your financing efficiently. Let's dive into the specifics you'll need to get started.

1. Proof of Income (Pay Stubs and W-2s)

Your income is the cornerstone of your mortgage application, as it directly proves your ability to handle monthly payments. Residential Acceptance Corporation (RAC Mortgage) needs to verify that you have a stable and reliable source of funds. Pay stubs and W-2 forms are the primary documents used for this verification, offering a clear and official record of your earnings.

These documents serve a crucial purpose in painting a detailed picture of your financial health. They show your gross pay, deductions for taxes and benefits, and your final take-home amount. This information is used to calculate your debt-to-income (DTI) ratio, a key metric in determining how much you can comfortably borrow.

What to Provide

Typically, RAC Mortgage will request the following documents to assess your income:

- Most Recent Pay Stubs: You will need to provide pay stubs covering a continuous 30-day period.

- W-2 Forms: Expect to submit your W-2s from the past two years to establish a consistent earnings history.

Key Insight: Having these documents ready at the start of your application process can significantly speed up underwriting. A complete and organized file demonstrates preparedness and helps your loan officer at RAC Mortgage build a strong case for your approval.

Actionable Tips for a Smooth Process

Gathering your proof of income is a vital step when determining what documents are needed for a mortgage. Keep these tips in mind:

- Stay Current: Ensure your pay stubs are dated within the last 30 days. Outdated stubs will be rejected.

- Be Thorough: If you work multiple jobs, provide pay stubs and W-2s for every source of income.

- Go Digital (and Physical): Keep organized digital copies in a dedicated folder on your computer and have physical copies ready, just in case.

- Request Official Versions: If your employer provides electronic-only pay stubs, ask for an official PDF copy on company letterhead to avoid any verification issues.

2. Tax Returns (Form 1040)

While pay stubs show your current income, federal tax returns provide a comprehensive, long-term view of your financial history. Residential Acceptance Corporation (RAC Mortgage) relies on your tax returns, specifically Form 1040, to verify income consistency over several years. This is especially crucial for self-employed borrowers or those with variable income sources like commissions or bonuses.

These documents give underwriters a complete picture that goes beyond your base salary. They reveal rental property income, business profits or losses, alimony payments, and significant investment gains. This information is used to confirm that the income you claim is stable and likely to continue, ensuring you can meet your future mortgage obligations.

What to Provide

RAC Mortgage needs a complete package to accurately assess your full financial situation. You should be prepared to submit:

- Complete Federal Tax Returns: Provide your full, signed federal tax returns from the past two years.

- All Schedules and Forms: This includes all accompanying documents like Schedule C for business income, Schedule E for rental income, and any K-1s you may have received.

Key Insight: For self-employed individuals, underwriters often average the net income from the last two years of your tax returns. It's vital to discuss your filing strategy with your loan officer at RAC Mortgage and your tax professional well before applying to maximize your qualifying income.

Actionable Tips for a Smooth Process

Providing accurate tax returns is a critical part of gathering what documents are needed for a mortgage. Use these tips to stay ahead:

- File Early: If you're planning to apply for a mortgage soon, file your taxes as early as possible to ensure the most recent year is available.

- Keep Everything: Submit every single page of your tax returns, even the blank ones. A complete submission prevents delays.

- Request IRS Transcripts: In some cases, your lender may need to verify your returns directly with the IRS. You can proactively request tax return transcripts from the IRS website for faster verification.

- Explain Fluctuations: If your income saw a significant drop or increase from one year to the next, prepare a clear, written letter of explanation to submit with your application.

3. Bank Statements

Your bank statements are a vital part of what documents are needed for a mortgage, providing a transparent view of your financial stability and discipline. Residential Acceptance Corporation (RAC Mortgage) scrutinizes these documents to verify you have the necessary funds for a down payment and closing costs. They also assess your cash flow patterns to confirm you can manage a monthly mortgage payment alongside your other expenses.

These statements offer a narrative of your financial life, showing your regular income deposits, spending habits, and savings consistency. This information is used to detect any red flags, such as large, undocumented deposits or frequent overdrafts, which could signal financial instability or borrowed funds that haven't been disclosed. A clean and consistent set of bank statements strengthens your application significantly.

What to Provide

RAC Mortgage will typically ask for complete statements from all your financial accounts, including checking, savings, and investment accounts. Be prepared to submit:

- Recent Bank Statements: You will need to provide statements covering the most recent 60-day period.

- All Pages: Ensure you include every page of each statement, even blank ones, as the full, unaltered document is required.

- All Accounts: Submit statements for any account where you hold significant assets, not just your primary checking account.

Key Insight: Any large, non-payroll deposit must be sourced and explained. If your parents gift you $10,000 for your down payment, you'll need a signed gift letter and proof of the funds leaving their account and entering yours. Proactively explaining these deposits to your RAC Mortgage loan officer prevents underwriting delays.

Actionable Tips for a Smooth Process

Managing your bank accounts carefully in the months leading up to your application is crucial. Here are some tips for a seamless review:

- Avoid Large Cash Deposits: The source of cash cannot be traced, so depositing large sums can create significant problems.

- Minimize Account Transfers: Moving money between your accounts can make it difficult for underwriters to track your funds. Keep your money in one or two primary accounts if possible.

- Maintain Healthy Balances: Avoid letting your accounts dip near zero or into overdraft. Consistent, healthy balances demonstrate financial responsibility.

- Document Everything: If you do receive a large, non-payroll deposit (like a bonus or gift), keep all related paperwork to provide a clear paper trail for your lender.

4. Employment Verification Letter

While pay stubs and W-2s show your earnings history, an Employment Verification Letter provides a real-time, official confirmation of your current job status. This formal letter, written by your employer, serves as direct proof to Residential Acceptance Corporation (RAC Mortgage) that you are gainfully employed and have a stable source of income to support a mortgage. It validates key details on your application, adding a crucial layer of credibility.

This document bridges the gap between past earnings and present stability. For instance, if you recently received a raise or promotion not yet reflected on your W-2s, this letter confirms that new, higher income. It assures the lender that your employment is secure at the very moment you are applying for one of life’s biggest financial commitments.

What to Provide

Your lender will need a formal letter from your employer's Human Resources (HR) department or your direct supervisor. The letter must be on official company letterhead and typically includes:

- Your Full Name and Job Title: Confirms your role within the company.

- Employment Start Date: Establishes your length of service and job history.

- Current Salary or Hourly Wage: Details your gross pay, including any bonuses or commissions.

- Employment Status: Specifies whether you are a full-time, part-time, or contract employee.

Key Insight: This letter is not just a formality; it’s a powerful tool for your loan officer at RAC Mortgage. A detailed letter, for example, noting a recent promotion or emphasizing the security of a government position, can significantly strengthen your application and instill lender confidence.

Actionable Tips for a Smooth Process

Requesting this letter is a key step when gathering what documents are needed for a mortgage. Use these tips to ensure it meets lender requirements:

- Request an Official Copy: Ask your HR department for the letter printed on official company letterhead, signed, and including their direct contact information for verification.

- Ensure Information Matches: Double-check that the salary, job title, and start date on the letter are identical to what you listed on your loan application. Discrepancies can cause delays.

- Time it Right: Obtain the letter close to the date you submit your mortgage application, as the information must be current, usually within 30 days.

- Give a Heads-Up: Inform your HR contact or manager that a representative from RAC Mortgage may call to verbally verify the information. This preparation prevents surprises and ensures a quick response.

5. Credit Report and Score Documentation

Your credit history is a fundamental pillar of your mortgage application, giving Residential Acceptance Corporation (RAC Mortgage) a detailed report card of your financial reliability. It showcases your payment patterns, existing debts, and overall creditworthiness. While RAC Mortgage will pull its own official report, reviewing your own copies beforehand empowers you to understand your financial standing and proactively address any potential red flags.

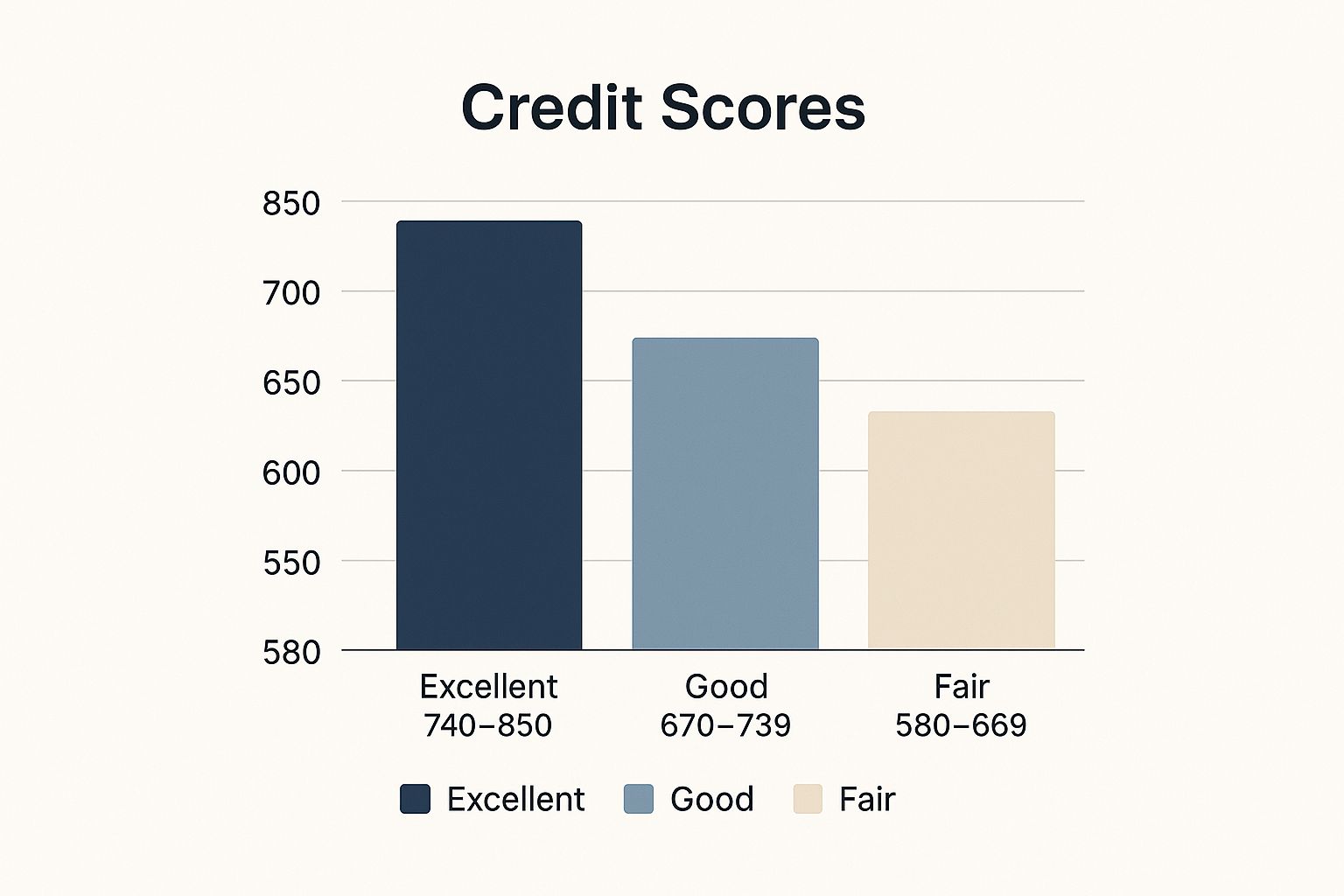

This documentation is essential for assessing risk. A strong credit profile, reflected by a high credit score, indicates a history of responsible borrowing and timely payments. For example, a borrower with a 780 FICO score often qualifies for the most competitive interest rates, while a first-time buyer with a 620 score may need an FHA loan with stricter terms. Proactively managing your credit can make a significant difference.

The bar chart below illustrates how credit scores are typically categorized, which directly impacts loan eligibility and pricing.

As the chart shows, moving from a "Fair" to a "Good" or "Excellent" credit score tier can unlock substantially better mortgage terms, saving you thousands over the life of the loan.

What to Provide

RAC Mortgage will pull a tri-merge credit report from all three major bureaus (Experian, Equifax, and TransUnion). However, you should prepare by:

- Obtaining Your Own Reports: Get free copies from AnnualCreditReport.com to review for inaccuracies.

- Providing Letters of Explanation: If there are any negative marks like late payments or collections, be ready to write a letter explaining the circumstances.

Key Insight: Discovering and disputing an incorrect late payment on your report can improve your score by 30 points or more. Finding these issues before your RAC Mortgage loan officer pulls your official report prevents last-minute delays and strengthens your application from the start.

Actionable Tips for a Smooth Process

Managing your credit is a critical part of preparing the documents needed for a mortgage. Use these strategies:

- Check Early and Often: Review your reports from all three credit bureaus well in advance of applying.

- Dispute Errors Immediately: The dispute process can take 30-45 days, so don't wait until the last minute.

- Maintain Old Accounts: Avoid closing old credit cards before your mortgage closes, as this can lower your average account age and hurt your score.

- Lower Your Balances: Pay down credit card balances to reduce your credit utilization ratio, which can provide a quick boost to your score. For more guidance, learn about how to repair bad credit on racmortgage.com.

6. Asset Documentation (Investment and Retirement Accounts)

Beyond your primary bank accounts, your broader portfolio of assets plays a significant role in demonstrating your financial stability. Documents for investment accounts, retirement funds like 401(k)s and IRAs, stocks, and bonds provide a complete picture of your financial strength. Residential Acceptance Corporation (RAC Mortgage) reviews these assets to confirm you have sufficient funds for a down payment and closing costs, as well as reserves for unexpected life events.

These documents are crucial for underwriting because they prove you possess a financial cushion beyond your regular income. This reassures the lender that you can manage your mortgage payments even if your primary income stream is temporarily disrupted. For some borrowers, these assets are the primary source for the down payment itself.

What to Provide

When gathering what documents are needed for a mortgage, you will typically need to provide complete statements for any relevant asset accounts:

- Investment Account Statements: Provide the two most recent quarterly or monthly statements for brokerage accounts, showing stocks, bonds, or mutual funds.

- Retirement Account Statements: Submit the most recent statement for any 401(k), IRA, or other retirement funds.

Key Insight: Even if you don't plan to use retirement funds for your purchase, showing these assets can strengthen your application. A healthy 401(k), for instance, signals to your loan officer at RAC Mortgage that you are a responsible and long-term financial planner, which can positively influence your loan approval.

Actionable Tips for a Smooth Process

Effectively presenting your assets is a key part of your mortgage application. Follow these tips:

- Provide All Pages: Submit the complete statement for each account, even if some pages are blank or contain legal disclaimers. Lenders need the full document.

- Understand Implications: Before deciding to liquidate assets, consult a financial advisor about potential tax consequences or early withdrawal penalties for retirement funds.

- Keep Reserves: It's preferable to see that you will still have liquid assets remaining after closing. Avoid completely depleting your accounts for the down payment.

- Document Large Deposits: If you recently moved a large sum from an investment account to your checking account for the down payment, be prepared to provide statements from both accounts to show the paper trail.

7. Property Information and Purchase Agreement

Once you've found your dream home and your offer is accepted, the focus shifts to the property itself. This stage requires a collection of documents centered around the home you intend to buy, starting with the legally binding purchase agreement. Residential Acceptance Corporation (RAC Mortgage) uses these documents to verify the property's value, confirm the terms of the sale, and ensure the title is clear for transfer.

These documents serve as the official record of the transaction. The signed purchase agreement outlines every detail from the sales price and closing date to any contingencies. This contract, along with the appraisal and title report, validates the collateral for the loan, which is the house itself. It’s a critical part of a complete list of what documents are needed for a mortgage because it connects your financial profile to a specific, valued asset.

What to Provide

Your lender will need the complete documentation related to the property to finalize the loan:

- Signed Purchase Agreement: A fully executed copy of the contract, signed by both you and the seller.

- Property Appraisal Report: An independent appraisal ordered by the lender to confirm the home's value meets or exceeds the sale price.

- Title Search and Insurance Policy: Documents proving the seller has the legal right to sell the property and that there are no outstanding liens or claims against it.

Key Insight: The purchase agreement dictates the timeline and conditions for the entire transaction. A well-written contract with clear financing and appraisal contingencies protects you if the property value comes in low or you cannot secure a mortgage, allowing you to exit the deal without losing your deposit.

Actionable Tips for a Smooth Process

Navigating the property documentation phase is essential for a timely closing. Keep these tips in mind:

- Review Before You Sign: Carefully read every clause in the purchase agreement. Ask your real estate agent or an attorney to clarify anything you don't understand.

- Organize Everything: Keep all property-related documents, including inspection reports and addendums, in a single, easily accessible folder.

- Order Title Work Early: Requesting the title search as soon as the property is under contract gives you time to resolve any potential issues, such as an unknown lien.

- Meet Your Deadlines: Pay close attention to dates specified in your contract for inspections, appraisals, and securing your loan commitment. Many programs have specific requirements, and you can explore various options, including down payment assistance programs, to help meet your financial obligations.

8. Debt Documentation (Loan Statements and Credit Obligations)

Just as your income shows money coming in, your debt documentation reveals money going out. A complete picture of your financial obligations is needed to accurately assess your ability to manage a new mortgage payment. This involves providing statements for all existing loans and credit lines, from car payments to student loans and credit card balances.

This information is essential for calculating your debt-to-income (DTI) ratio, a critical factor in underwriting. For example, a borrower with a $45,000 annual income and $500 in monthly debt payments has a DTI of 13%. Even student loans in forbearance are typically factored into this calculation. Residential Acceptance Corporation (RAC Mortgage) uses these documents to ensure your new mortgage payment fits responsibly within your budget.

What to Provide

You will need to gather statements for every single debt you hold. Be prepared to submit the following:

- Loan Statements: Provide the most recent statements for auto loans, student loans, personal loans, and any other installment debt.

- Credit Card Statements: Include the latest statement for all credit cards, showing the current balance and minimum payment.

- Other Obligations: If you pay alimony or child support, you must provide documentation like a divorce decree or court order detailing the payment amount and terms.

Key Insight: Full transparency is non-negotiable. Attempting to hide a debt will inevitably be discovered during the credit check, causing significant delays or even denial. Presenting all your debt documentation upfront allows your loan officer at RAC Mortgage to strategize the best path forward for your approval.

Actionable Tips for a Smooth Process

Managing your debt documentation is a crucial part of preparing your mortgage application. When considering what documents are needed for a mortgage, follow these tips:

- Reduce Balances: If possible, pay down high-balance credit cards before applying to lower your DTI ratio.

- Maintain Status Quo: Do not open new credit accounts or close existing ones during the mortgage process. Such changes can negatively impact your credit score and DTI.

- Organize and Update: Gather the most recent statement for every debt. Keep them organized in a dedicated digital or physical folder.

- Address All Debts: Even loans that are in deferment or forbearance must be disclosed with supporting documentation. A future payment will still be accounted for.

Mortgage Document Requirements Comparison

| Document Type | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases | Key Advantages ⭐ / Tips 💡 |

|---|---|---|---|---|---|

| Proof of Income (Pay Stubs & W-2s) | Low – Standardized, easy to obtain | Minimal – Employer provided | Quick income verification | Traditional employees, salaried borrowers | ⭐ Standard format, shows consistent income 💡 Use recent stubs, include multiple jobs |

| Tax Returns (Form 1040) | Medium – Requires gathering multiple forms and schedules | Moderate – Tax professional support may be needed | Comprehensive annual income verification | Self-employed, businesses, multiple income sources | ⭐ Most comprehensive income view 💡 File early, prepare explanations for anomalies |

| Bank Statements | Low to Medium – Collecting recent statements | Minimal – Accessible from banks | Verification of assets, cash flow, reserves | Buyers with savings or multiple accounts | ⭐ Shows real-time financial habits 💡 Avoid unusual deposits, maintain balance |

| Employment Verification Letter | Low to Medium – Requires employer cooperation | Minimal to Moderate – Employer HR involvement | Confirms current employment status | Borrowers with stable jobs, recent promotions | ⭐ Direct employer confirmation 💡 Get on letterhead, match loan application details |

| Credit Report and Score | Low – Reports are pulled for you, borrower obtains copies | Minimal – Free or paid agency copies | Assesses creditworthiness, loan eligibility | All borrowers | ⭐ Determines loan terms 💡 Check reports, dispute errors, manage credit utilization |

| Asset Documentation | Medium – Collect statements from various accounts | Moderate – Multiple financial institutions | Demonstrates financial strength, backup funds | Buyers with investments or retirement funds | ⭐ Shows long-term stability 💡 Understand liquidity, watch for penalties |

| Property Info & Purchase Agreement | Medium to High – Multiple documents, appraisal, title | Moderate – Coordination with agents, appraisers | Establishes property value and loan basis | All homebuyers | ⭐ Legal protection, defines loan limits 💡 Review carefully, order title work early |

| Debt Documentation | Medium – Collect all loan and credit details | Moderate – Multiple creditors involved | Calculates debt-to-income ratios | Borrowers with existing debts | ⭐ Complete financial obligation visibility 💡 Pay down balances, organize statements |

Partner with RAC Mortgage for a Streamlined Closing

Navigating the mortgage application process can feel like a monumental task, but as we've detailed, it truly boils down to careful preparation and organization. Having a comprehensive understanding of what documents are needed for your mortgage is the single most powerful step you can take toward securing your new home. This isn't just about checking boxes; it's about building a strong, verifiable financial narrative that proves your readiness for homeownership.

From your recent pay stubs and W-2s to your full federal tax returns, each document serves a specific purpose, collectively painting a clear picture for underwriters. Your bank statements and asset documentation demonstrate your financial stability and capacity for a down payment, while your credit report and debt statements provide a transparent look at your history of managing financial obligations. The purchase agreement itself is the final piece of the puzzle, officially connecting your financial profile to a specific property.

From Paperwork to Partnership

The ultimate goal of gathering these documents is to transform a complex process into a simple, streamlined experience. When you have your file organized and ready, you empower RAC Mortgage to work efficiently on your behalf. A complete and accurate submission eliminates the frustrating back-and-forth requests for missing information, which are often the primary cause of closing delays.

Key Takeaway: Your preparedness is the catalyst for a fast and efficient closing. By assembling a complete document package upfront, you enable your lender to move your application from submission to approval with minimal friction and maximum speed.

This level of organization allows a dedicated partner like RAC Mortgage to leverage its streamlined process effectively. Their internal goal of closing loans in 18 to 20 days is ambitious, and it relies on a strong partnership with you, the borrower. When you provide all the necessary information from the start, you are holding up your end of the partnership, allowing their expert team to focus on finding the best loan terms and guiding you to the closing table without unnecessary stress.

Your Next Steps on the Path to Homeownership

Mastering this checklist does more than just prepare you for a loan application; it equips you with financial clarity. You gain a deeper understanding of your own financial standing, empowering you to enter negotiations and make decisions with confidence. This isn't just about getting a mortgage; it's about starting your journey as a homeowner on the strongest possible footing.

Think of this document checklist not as a hurdle, but as your roadmap. Each item you gather is a step forward, bringing you closer to the moment you receive the keys to your new home. With your documents in hand, you are no longer just a prospective buyer; you are a well-prepared applicant ready to achieve your dream.

Ready to turn your preparation into action? The expert team at Residential Acceptance Corporation specializes in making the mortgage process clear and efficient, providing the one-on-one support needed to navigate what documents are needed for a mortgage. Visit Residential Acceptance Corporation to connect with a loan officer and experience a truly streamlined path to homeownership.