Picture this: you've just closed on your dream home in Tampa. You've got the keys, the moving truck is booked, and you're ready to start your new life. Then, years down the line, a legal notice arrives. It turns out a long-lost heir of a previous owner is staking a claim on your property.

This is the exact nightmare scenario title insurance is for. It's designed to protect you from these kinds of hidden risks that can pop up from a property's past. Simply put, it protects you and your mortgage lender from financial loss caused by defects in the property's title.

What Is Title Insurance for in Real Estate?

It’s helpful to think of title insurance less like your standard homeowner's policy and more like a deep-dive investigation into your property's history, one that's backed by a serious financial guarantee.

While your homeowner's insurance protects you from future events—think fires, floods, or theft—title insurance looks backward. It protects against ghosts from the past. Its entire purpose is to uncover and sort out any ownership issues before you ever get to the closing table on your Tampa home.

This is a one-time purchase, almost always paid at closing, that ensures your right to own the property is free and clear of old claims, surprise liens, or even outright fraud. It buys you long-term peace of mind, knowing your investment is truly yours.

Securing Your Financial Future

At Residential Acceptance Corporation (RAC Mortgage), we always stress how vital title insurance is for securing your investment in Tampa. It’s not just another line item on your closing statement; it’s a fundamental shield against potentially devastating financial and legal battles. A sound Tampa real estate deal always includes it.

The market reflects its importance. The global title insurance market was valued at $4.15 billion in 2025 and is expected to climb to $5.69 billion by 2034, all thanks to the steady hum of real estate activity.

Title insurance provides a shield against the unknown. It addresses everything from simple clerical errors in public records to complex issues like undisclosed heirs or fraudulent deeds from previous owners.

Essentially, it's a defense of your ownership rights. If someone makes a claim against your title after you've bought the home, the insurance company steps in. They'll cover the legal fees to fight that claim and, if the claim is valid, they'll compensate you for the financial loss.

This one-time premium is paid out of your closing costs, which are sometimes handled through your escrow account. You can learn more about what a mortgage escrow account is and how that works. At the end of the day, providing this foundational security is what title insurance is for.

Lender's vs. Owner's Title Insurance: What's the Difference?

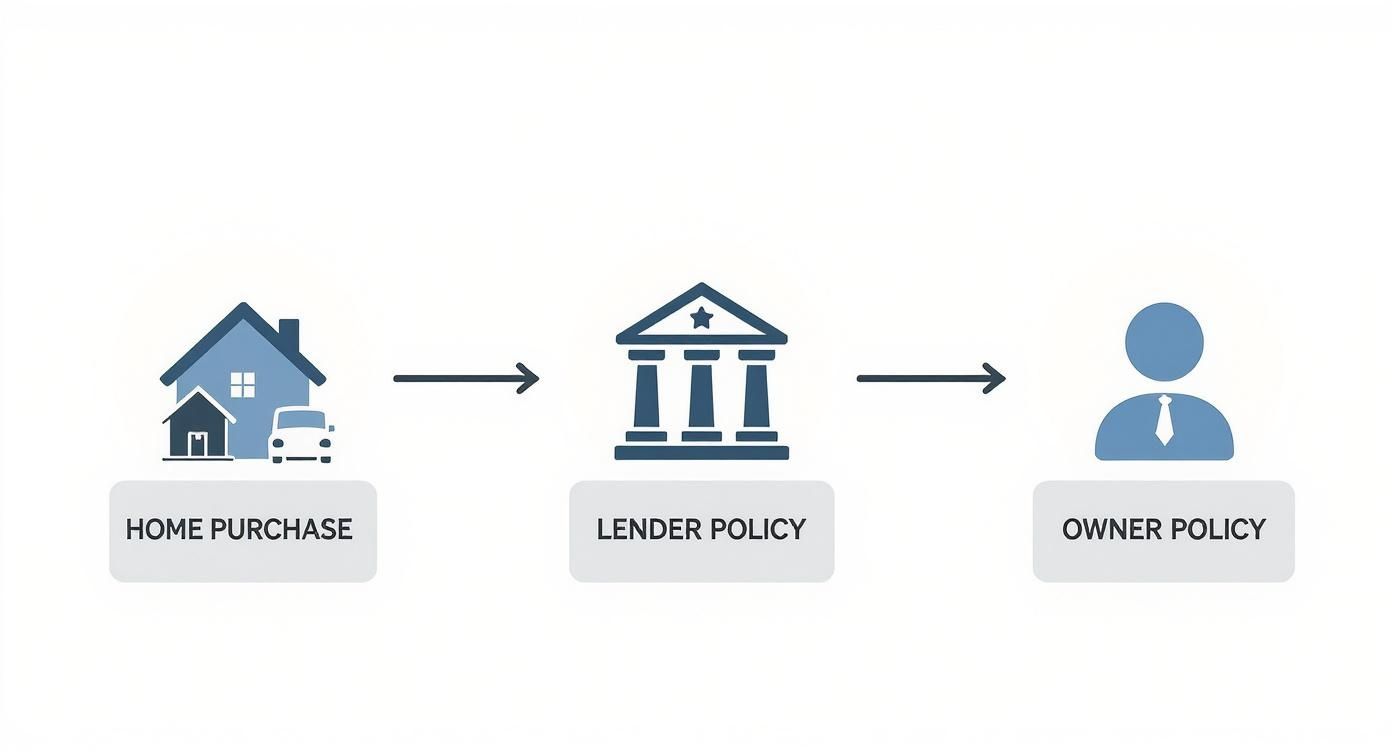

When you’re buying a home in Tampa, you’ll quickly learn that title insurance isn’t a one-size-fits-all product. There are actually two different types, and each one protects a different party in the deal. Getting a handle on what title insurance is for really starts with understanding the distinction between a lender’s policy and an owner’s policy.

The Two Shields of Title Protection

A Lender's Title Insurance Policy is almost always a non-negotiable part of getting a mortgage in Tampa. Lenders, including us here at RAC Mortgage, require this coverage because it protects their investment in your property. If a hidden title issue pops up down the road, this policy ensures the lender's financial stake is safe. It stays in effect until you pay off the loan, and the cost is usually rolled into your closing costs as a homebuyer.

Then there’s the Owner's Title Insurance Policy. This one is all about protecting you. While technically optional, it’s a critical safeguard for your equity and your legal right to own the property. You pay a one-time fee at closing, and in return, you get protection against surprise title claims for as long as you or your heirs own the home.

Think of them as a team. The lender's policy guards the loan itself, while the owner's policy guards your personal investment and your ownership rights. They work together to secure the property from past problems.

These two policies make up the whole title insurance market. And it’s a big market. Owner's title insurance was valued at $1.5 billion back in 2023 and is expected to climb to $2.1 billion by 2032. Over that same time, lender's policies are projected to grow to $2.4 billion, which just goes to show how vital both are in the real estate world. You can discover more about the title insurance market and its growth.

An owner's policy is your personal armor against past title problems. Without it, you could be left to pay for expensive legal battles to defend your ownership, even if you weren't responsible for the original error.

For anyone buying a home in Tampa, getting an owner's policy is one of the smartest moves you can make. It takes the terrifying possibility of a financial nightmare from a hidden title flaw and turns it into a manageable issue handled by your insurance. That peace of mind is what title insurance is for.

How a Title Search Uncovers a Property's Past

Before a title insurance policy can even be written for your Tampa home, a deep-dive investigation known as a title search has to happen. You can think of it as a detailed background check on the property itself.

Title professionals essentially become property detectives. They meticulously dig through public records to piece together a clear, unbroken history of ownership—what we in the industry call the "chain of title."

This involves sifting through decades of paperwork. They'll review old deeds, mortgages, court judgments, tax records, and just about anything else that could affect ownership. The real value of title insurance starts to become obvious here: the whole point is to find and fix problems before you ever get to the closing table.

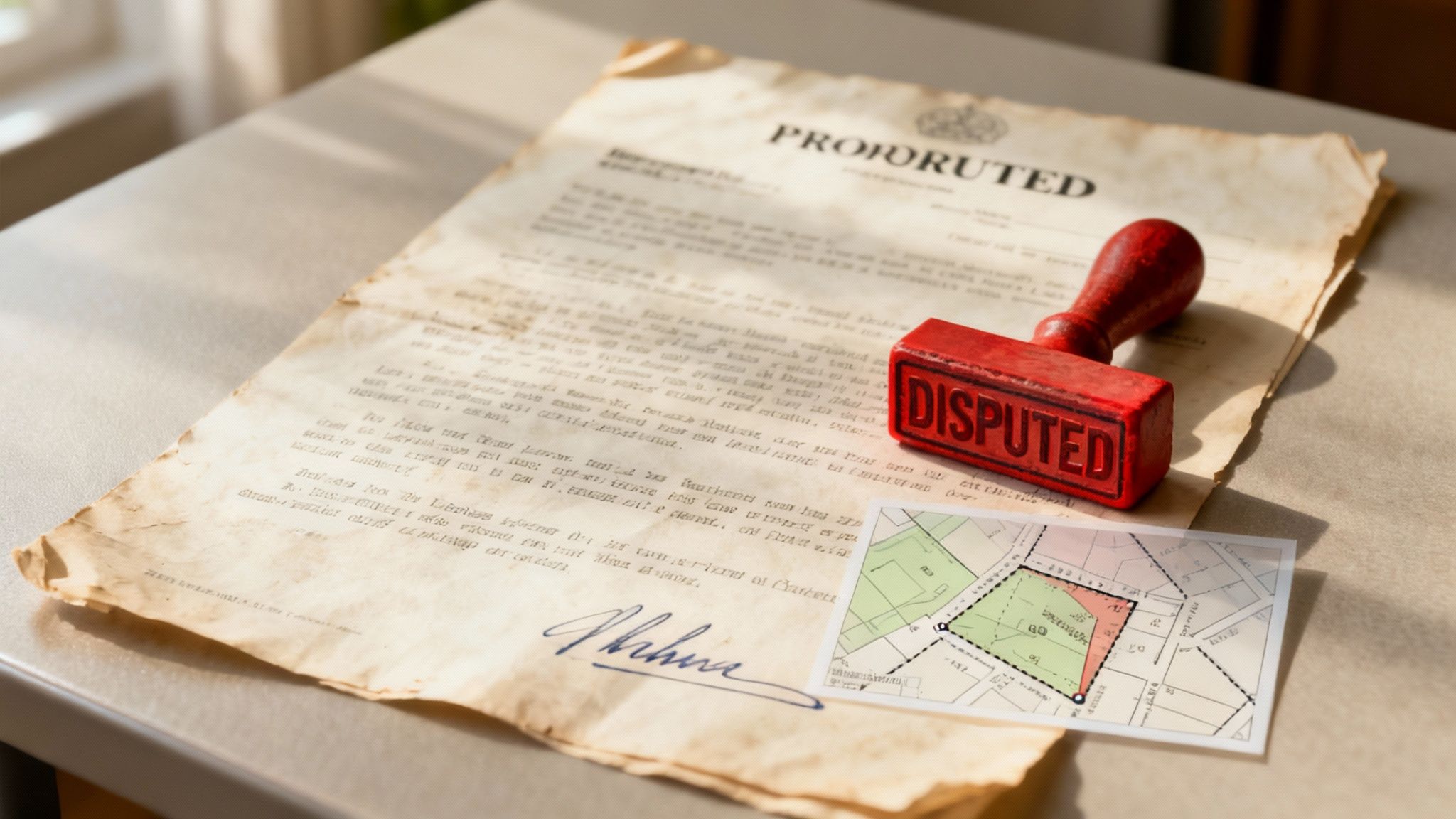

This crucial step often turns up issues, sometimes called "clouds" on the title.

Common Issues Found During a Title Search

- Unresolved Liens: Maybe a previous owner never paid a contractor for a kitchen remodel, or they have outstanding property taxes. These can result in a legal claim—a lien—against the property.

- Undisclosed Heirs: It sounds like something from a movie, but it happens. Someone who inherited a small piece of the property years ago could suddenly surface with a valid ownership claim.

- Filing Errors: A simple typo or clerical mistake in the public record from 40 years ago can create massive confusion and headaches today.

- Boundary Disputes: That fence your new neighbor put up? A title search might reveal it’s actually a foot onto your property, creating a legal mess.

This infographic breaks down how both the lender's and owner's policies come into play during the home purchase to protect everyone involved.

As you can see, both policies are critical parts of a secure deal, protecting the bank’s investment and your hard-earned equity. Getting your paperwork in order is a big part of this, and it helps to review the documents needed for a mortgage ahead of time.

The title search is all about prevention. It's designed to clear up these historical snags so you can receive a "clear title." That means your ownership is secure and undisputed from the moment you get the keys.

Common Title Problems That Can Derail a Home Purchase

The real value of title insurance clicks into place when you see the kind of disasters it helps you sidestep. A title search is a fantastic start, but it’s not a crystal ball. It can’t always catch the weird, messy stuff from decades ago, especially things involving fraud or unrecorded documents.

These are the hidden problems that can pop up and threaten your ownership rights long after you've unpacked the last box in your new Tampa home.

Imagine finding out a deed from 50 years ago was signed with a forged signature. Without an owner's title policy, you’d be facing an expensive, stressful legal fight just to prove you actually own your home. This is exactly what title insurance is for—it shields you from the financial chaos of someone else's past mistakes.

These "title defects," as they're called, come in all shapes and sizes. And every single one has the power to put your investment at risk.

Real-World Scenarios That Title Insurance Covers

Even when a title search comes back looking squeaky clean, some issues can stay buried, just waiting to cause trouble later. Here are a few real-life headaches any Tampa homebuyer could face:

- An Unknown Heir Appears: A previous owner's long-lost relative could show up out of the blue with a legitimate legal claim to a piece of your property. Title insurance handles the legal defense and covers your financial losses if their claim holds up.

- Hidden Easements: You've got big plans for a backyard pool, only to discover there’s an undisclosed utility easement cutting right through the middle of your yard, making construction impossible.

- Contractor Liens: A roofer who worked on the house for the last owner never got paid. They can slap a lien on the property, and suddenly, you're on the hook for that debt.

- Filing Errors and Fraud: Simple typos in public records or, worse, intentionally fraudulent documents from a past sale can create massive ownership battles years down the road.

These examples show why getting a "clean" report from a title search isn't the final word. Many of these problems are literally impossible to spot until it's far too late.

An owner's policy transforms a potential financial nightmare into a manageable, covered event. It defends your right to the property and protects the equity you’ve worked so hard to build.

Certain situations, like navigating the complexities of a probate sale, are especially prone to title drama. This is also where other safeguards in your purchase agreement become so important. Understanding things like a mortgage contingency clause can give you another layer of security during the buying process. You can learn more about how a mortgage contingency works from our experts right here at RAC Mortgage.

At the end of the day, title insurance is the final, lasting line of defense for your biggest investment.

Alright, let's get into the nitty-gritty. For most Tampa homebuyers, the big question is always a practical one: "What's this actually going to cost me?"

When it comes to title insurance in Florida, the state actually regulates the pricing. This is great news for consumers because it keeps things fair and consistent across the board.

So, How Much Are We Talking?

Unlike your homeowner's insurance policy that hits your bank account every year, title insurance is a one-time premium you pay at the closing table. That's it. One and done.

This single payment protects you for as long as you or your family own the property. You'll never see another bill for it, which is a nice change of pace.

How The Premium Is Calculated

The cost is tied directly to the home's purchase price. Think of it this way: a sprawling home on Bayshore Boulevard carries a higher premium than a cozy condo over in Seminole Heights. It makes sense, right? The insurance company is taking on more financial risk with a higher-value property.

This isn't some small, niche product, either. By the second quarter of 2025, total title insurance premiums in the U.S. ballooned to $4.5 billion—a 10% jump from the year before. That tells you just how essential this protection is in the real estate world. You can read more about recent title insurance industry results to get a sense of the scale.

This one-time fee is a small price to pay for a lifetime of security. It's not just another closing cost; it's a powerful and lasting investment in your financial safety and peace of mind.

At the end of the day, that's what title insurance is for: providing an affordable, one-and-done shield against potentially devastating ownership problems that could pop up years down the road.

How RAC Mortgage Helps Secure Your Investment

Buying a home in Tampa can feel like you're juggling a dozen different things at once. It's easy to get overwhelmed, but you really don't have to go through it alone. This is where having a seasoned local partner can make all the difference.

At Residential Acceptance Corporation (RAC Mortgage), we walk Tampa homebuyers through every single step. That includes making sure you understand exactly what title insurance is for. Our job is to see that all the puzzle pieces—from finding the right loan to protecting your legal ownership—snap together perfectly.

We're here to protect your interests, simple as that. From the moment we start working together until you have the keys in hand, our commitment is to not only get your financing sorted but also to make sure your property rights are locked down for years to come.

Your Partner in Protection

Our team makes sure you’re fully looped in on essential safeguards like an owner's title policy, which is a non-negotiable part of any secure home purchase. We believe that protecting our clients is the key to a smooth, stress-free closing. To get a better handle on how we secure your investment, it's worth taking a look at the bigger picture of how to qualify for a mortgage.

A trusted mortgage partner does more than just push your loan application through. They're your advocate, making sure every detail that protects your investment—including title insurance—is handled correctly and explained clearly.

At the end of the day, RAC Mortgage is here to make sure your journey to owning a Tampa home isn't just successful, but also secure for the long haul.

A Few Common Questions About Title Insurance

Buying a home in Tampa always stirs up a few questions, especially about the finer details. Let's tackle some of the most common things we hear about title insurance so you can feel totally confident as you move forward.

If a Title Search Was Done, Why Do I Still Need Insurance?

This is a great question, and we hear it all the time. A title search is absolutely essential, but it can only flag issues that are part of the public record. It's not going to catch hidden threats like a forged signature on a past deed, fraud, or a simple clerical error buried in county records from decades ago.

Think of it this way: a title search is like checking the car's maintenance history. Title insurance is like having a warranty that protects you if the engine blows up because of a hidden defect the mechanic couldn't possibly have seen. It protects you from the unknown.

How Long Is My Owner's Policy Good For?

This is one of the best parts about owner's title insurance. You pay a one-time premium at closing, and that policy protects you for as long as you or your heirs own the property. It doesn't expire. That single payment provides a lifetime of protection against title defects from the past.

Can I Pick My Own Title Company in Tampa?

Yes, you absolutely can. In fact, it's your right. Both Florida law and the federal Real Estate Settlement Procedures Act (RESPA) give you, the homebuyer, the right to choose your own title insurance provider. Your real estate agent might suggest a company they've worked with before, but the final call is always yours.

It's Your Call: As a homebuyer in Tampa, you're in the driver's seat. You can and should shop around for a title company. Compare their services, check their fees, and find a team that makes you feel comfortable with one of the biggest purchases of your life.

This is a really important protection for consumers, giving you more control over the closing process.

Does Title Insurance Cover Problems in the Future?

This is a key point to understand: no, it doesn't. Title insurance is unique because it looks backward, not forward. It’s designed to shield you from financial harm caused by events that already happened in the property's history, even if they're just coming to light now. Think old liens, a previously unknown heir, or mistakes in old public records.

For things that might happen in the future—like a fire, a storm, or theft—that’s what your homeowner's insurance is for. The two policies work hand-in-hand to protect your property's past and its future.

Here at Residential Acceptance Corporation, our main goal is to make sure our Tampa clients feel informed, prepared, and protected. If you've got more questions about title insurance or you're ready to get started on your home financing, our team of experts is ready to help. You can explore your mortgage options with us over at https://racmortgage.com.